Cheap Full Coverage Car Insurance in Michigan

Explore smart ways to lower your Michigan full coverage premium while staying fully protected on the road.

Compare Quotes in 2 Minutes

Powered by:

Secured with SHA-256 Encryption

When drivers ask about cheap full coverage car insurance in Michigan, our first response is usually, “Let’s be real — Michigan is a no‑fault state with some of the highest auto‑insurance bills in the country.” That doesn’t mean you’re doomed to pay a fortune. With the right strategy, you can snag affordable auto insurance that still protects your ride, your finances and that peace‑of‑mind feeling every time you hand over the keys. In this guide, we’ll break down what “full coverage” actually means in the Great Lakes State, why it’s often a smart choice, and how to keep costs from ballooning.

- Michigan’s no-fault system makes insurance more complex and often more expensive than in other states.

- "Cheap” full coverage is relative—what’s affordable for one driver may not be for another.

- Your age, ZIP code, and driving record all play a big role in what you’ll pay.

- Insurance quotes can vary widely between companies, so shopping around is always essential.

Why Full Coverage Matters in the Great Lakes State

In Michigan’s no‑fault system, drivers use their own policies to cover injury bills regardless of who caused the crash. Minimum liability policies meet state‑required limits, but they won’t fix your car or replace it if it’s stolen or vandalized. Full coverage adds collision and comprehensive protection so you’re covered after most accidents, theft, or hailstorms. One of our customers reviewed about her college‑age son, who opted for liability only because it was “cheaper.” After a deer jumped onto M‑28 and crunched his bumper, he realized his bargain policy didn’t help at all. The repair bill? Correct! That came out of his own pocket.

Beyond collision and comprehensive, Michigan requires Personal Injury Protection (PIP). Recent reforms let you choose PIP levels instead of the old unlimited coverage. Picking the right level can dramatically affect your premium and may be something to discuss with your agent or family.

What Does “Cheap” Look Like? Average Costs and Variations

So what’s a fair price for full coverage? It depends on where you look. The Zebra reports average full‑coverage premiums around $1,292 for a six‑month policy, while NerdWallet’s data shows $3,034 per year. On the liability side, you might see annual costs between $695 and $1,744, but those bare‑bones policies leave you financially exposed.

Here’s a snapshot of typical monthly premiums for some well‑known insurers (prices can vary based on your age, driving history and ZIP code):

| Company | Est. Monthly Full‑Coverage Cost* | Notes |

|---|---|---|

| GEICO | Often the cheapest for clean driving records, strong online tools | Lowest rates, but membership limited to military families |

| USAA | $106 | Competitive after a DUI, but rates rise after violations |

| Auto‑Owners | $105–$115 | Great customer service; solid option for teens and accident history |

| Progressive | $195–$229 | Competitive after a DUI but rates rise after violations |

| Westfield | $258–$276 | Regional carrier with good customer satisfaction |

| Liberty Mutual | $214–$235 | Lots of discounts; higher base rate |

*Estimates compiled from September 2025 data across multiple sources and should be used as general guidance.

The numbers also vary dramatically by city. Drivers in Detroit can pay more than double what motorists in Grand Rapids or Lansing pay. Add a speeding ticket or accident to your record and your premium can jump by hundreds of dollars. Recent reports even predict state rate increases of around 8% by the end of this year. This is partly due to a recovery commission from the Michigan Catastrophe Claims Association.

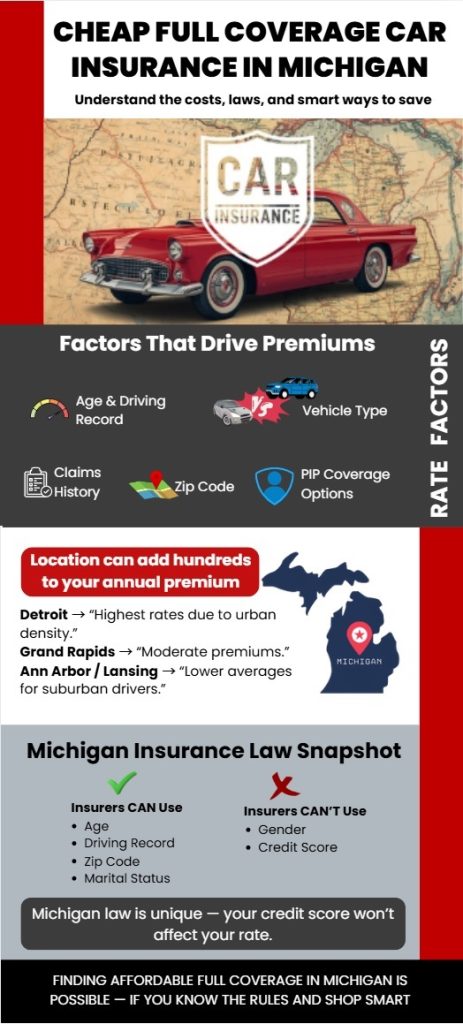

Factors That Influence Your Michigan Premium

Michigan insurance law prohibits insurers from using gender or credit scores in their pricing. However, they may consider factors such as age, zip code, accident history, claims history, marital status, and vehicle type. Your Personal Injury Protection (PIP) choices also play a big role—unlimited PIP can be pricey but can save you thousands if injuries occur. Together, these factors shape what you pay and highlight why no two drivers face identical premiums.

Your Age & Driving Record

Drivers in their teens and twenties are statistically more likely to crash, and insurers price accordingly. NerdWallet notes that thirty- and forty-somethings see rates drop substantially, but costs rise again in your 70s. A single speeding ticket can cause premiums to spike, and drivers with a DUI may even see monthly costs triple. The good news? Violations don’t stay on your record forever. With safe driving and time, your rates will eventually come back down.

Where You Live: Cities and Neighborhoods

Where you park your car at night matters as much as how you drive. Urban ZIP codes like Detroit come with more traffic and theft, which means higher claims and higher premiums. Rural or suburban areas, such as Grand Rapids tend to cost less.

Detroit’s dense traffic and higher theft rates push average full-coverage premiums well above $300 per month, while Grand Rapids averages closer to $196. Sterling Heights, Lansing, and Ann Arbor fall somewhere in between. Even within a single city, rates can differ by neighborhood, so always use your exact ZIP code when getting quotes. If you’re planning a move, it may be worth running new numbers before signing a lease.

Compare Quotes in 2 Minutes

Compare Insurance Quotes and Save!

Secured with SHA-256 Encryption

What You Drive

Your car matters too. Newer, more expensive cars cost more to repair, so they also cost more to insure. Sports cars and high-horsepower models tend to carry higher premiums since they’re linked with faster driving and higher accident risks. On the flip side, older vehicles often qualify for lower rates. Additionally, it makes sense to eliminate collision coverage for these vehicles, which can significantly reduce your costs.

Coverage Choices & Deductibles

You can reduce your premium by choosing a higher deductible or adjusting your PIP level. Just remember that a lower price tag means more out‑of‑pocket expenses if something goes wrong. Consider how much financial risk you’re comfortable with and whether you could afford repairs or medical bills on your own.

Top Insurers for Cheap Full Coverage Car Insurance in Michigan

All the research points to a handful of carriers that consistently deliver low rates:

- GEICO – Regularly shows up as the cheapest for drivers with clean records. Offers robust digital tools and telematics discounts.

- USAA – The absolute lowest for liability and full coverage, but you or a family member must have military affiliation.

- Auto‑Owners – Praised for customer experience and often cheapest for teens and drivers with accident history.

- Travelers – MoneyGeek’s top overall pick for affordability and customer service.

- Progressive – Competitive for high‑risk drivers (e.g., after a DUI).

- Westfield / Farm Bureau – Regional carriers sometimes offer lower rates than national brands, especially for liability.

Every insurer has pros and cons. GEICO and USAA lead on price, but some drivers prefer the personal touch of Auto‑Owners or Travelers. Progressive’s Snapshot® program can reward safe driving but may penalize risky habits. Be sure to get multiple quotes and compare not only the premium but also the coverage limits, deductible options and customer‑service reputation.

Compare Quotes in 2 Minutes

Compare Insurance Quotes and Save!

Secured with SHA-256 Encryption

Money‑Saving Tips and Discounts

Here’s the deal: there are tons of ways to knock dollars off your premium. Check out these suggestions:

- Good‑driver and claims‑free discounts – Many insurers reward a clean record.

- Defensive‑driving courses – Completing an approved class can earn a price break.

- Multi‑policy and multi‑vehicle bundles – Combining home and auto policies or insuring multiple cars often yields the biggest savings.

- Low‑mileage or usage‑based programs – If you don’t drive much, telematics devices or apps like GEICO’s DriveEasy can lower your bill.

- Student and good‑grade discounts – If you’ve got a teen driver, maintain those A’s!

- Anti‑theft and safety‑feature discounts – Installing alarms or having factory safety features may reduce your comprehensive premium.

A family near Lansing can save more than $400 a year just by bundling their homeowners and auto policies and allowing their child to take a defensive driving course. Meanwhile, in Detroit, simply installing a dashcam can provide a small but welcome discount, plus peace of mind if a claim ever came up.

Special Situations and High‑Risk Drivers

Got a ticket, accident or even a DUI? Your rates will jump, sometimes dramatically. The Zebra’s data shows premiums nearly doubling after a single at‑fault accident and skyrocketing after a DUI. The cheapest full‑coverage option after a DUI might switch from GEICO to Progressive or USAA, depending on your profile. Shopping around becomes essential.

High‑risk drivers should:

- Compare quotes from smaller regional carriers along with national brands.

- Ask about accident forgiveness or safe‑driving programs.

- Consider higher deductibles to keep premiums manageable.

- Maintain continuous insurance coverage—even a short lapse can raise future rates.

- Take advantage of available defensive‑driving courses; Michigan courts sometimes recommend these after violations.

For low‑income drivers struggling to afford full coverage, explore vehicles with lower replacement value (so you can opt for liability only) and seek out every discount possible. Michigan doesn’t offer a state‑subsidized program, but there’s no penalty for shopping around frequently.

FAQs and Common Misconceptions

If your car’s market value is only a few thousand dollars and you could afford to replace it, dropping collision and comprehensive might make sense. Otherwise, full coverage protects you from paying out of pocket after a crash, theft or hail damage.

Penalties include fines up to $500, license suspension and even jail time for repeat offenses. Don’t risk it—there’s always a cheaper policy if you look hard enough.

Unlike most states, Michigan bars insurers from using credit scores or gender to set your auto‑insurance rates. They can still consider age, driving history, vehicle type and location.

No, full coverage doesn’t cover every possible event. It typically includes liability, collision, and comprehensive, which protect against accidents, theft, vandalism, and weather damage. But it won’t pay for wear and tear, mechanical breakdowns, personal items in the car, rideshare or delivery use without special coverage.

Final Thoughts on Michigan Car Insurance

Cheap full coverage car insurance in Michigan isn’t a myth; it just takes some legwork. By understanding the state’s unique no‑fault and PIP rules, comparing quotes from multiple insurers and taking advantage of discounts, you can protect yourself without draining your bank account. Keep an eye on rate trends, revisit your policy annually and remember—insurance is one of the few products you hope you never need to use, but when you do, you’ll be glad you opted for the right coverage.

Compare Quotes in 2 Minutes

Secured with SHA-256 Encryption