Very Cheap Car Insurance No Deposit

Get Very Cheap Car Insurance With No Deposit Online. Cheap Rates From Just $29 /month.

Compare Insurance Quotes and Save!

Secured with SHA-256

Encryption

What is Very Cheap Car Insurance No Deposit?

Traditionally, car insurance policies often require a deposit or down payment as part of the policy initiation process, which can sometimes be a significant amount. This upfront cost serves as a portion of the policy’s overall expense and is typically required to activate the coverage. On the other hand, very cheap car insurance with no deposit is an insurance policy option designed for individuals seeking to obtain cheap auto insurance coverage without the requirement of paying an upfront deposit.

The “no deposit” aspect refers to the insurer waiving the initial payment, allowing policyholders to start their insurance coverage without needing to pay a large sum upfront. Instead, the costs are distributed over the policy term, usually in the form of monthly payments.

While the term “very cheap car insurance no deposit” might suggest a lower level of coverage, it simply means the insurer offers the policy at a cheap price but without the initial financial barrier, potentially including the same comprehensive coverage options available with traditional policies.

Who Needs No Deposit Auto Insurance?

Very cheap car insurance with no deposit is particularly suited for individuals who are looking to minimize their initial out-of-pocket expenses when obtaining car insurance and get affordable rates. This includes:

- Young drivers or students who may not have large sums of money available upfront.

- People experiencing temporary financial hardship who need to prioritize their spending but still require legal driving coverage.

- Individuals with fluctuating income, such as freelancers or gig economy workers, who prefer lower initial costs.

- First-time insurance buyers looking for an accessible entry point into getting auto insurance without the burden of a large deposit.

Benefits of Very Cheap Car Insurance No Deposit

Opting for very cheap car insurance with no deposit presents numerous advantages, making it an attractive option for a wide range of drivers. This approach significantly enhances the accessibility of auto insurance, particularly for individuals who might struggle with the upfront financial commitment typically required to initiate a policy.

The benefits of opting for no-deposit car insurance include:

- Lower Initial Costs: Eliminates the need for a hefty upfront payment, making insurance more accessible.

- Immediate Coverage: Allows drivers to obtain coverage quickly without waiting to save up for a deposit.

- Budget Management: Helps individuals manage their monthly budgets more effectively by spreading out insurance costs.

- Increased Accessibility: Opens up car insurance options to a wider audience, including those who might not be able to afford traditional insurance products.

Overall, very cheap car insurance no deposit removes significant financial hurdles, making it easier for drivers to obtain and maintain the insurance coverage they need. With the added benefits of flexibility, convenience, and cost management, it’s clear why these plans have become so popular among consumers looking to balance affordability with reliable auto insurance protection.

Why is Cheap Car Insurance With No Deposit Offered?

Insurance companies offer very cheap car insurance with no deposit as part of a strategic approach to:

- Expand Their Customer Base: By removing the upfront cost barrier, insurers can attract a wider range of customers, including those who might find it difficult to pay large deposits upfront.

- Maintain Market Competitiveness: In an industry where competition is fierce, offering no deposit options serves as a way for companies to distinguish themselves by providing more flexible payment arrangements.

- Lower Barriers to Coverage: Simplifying the entry process into insurance agreements encourages a greater number of drivers to obtain insurance, which is beneficial both for public safety and the companies’ business models.

- Respond to Consumer Needs: Recognizing the demand for more affordable and accessible insurance solutions, insurers adapt their products to meet these expectations, ensuring they remain relevant and appealing to potential clients.

However, it’s important to note that while there are significant advantages to no deposit auto insurance policies, they might not be available from all insurers, and the overall premiums could be higher. This is often a trade-off for the convenience of spreading payments over time without the need for an upfront deposit. For those seeking the most cost-effective option, paying the annual premium in one lump sum, when possible, remains the cheapest route. Nonetheless, the flexibility and accessibility of no deposit insurance plans play a crucial role in making car insurance more attainable for a broader segment of the population.

Which Companies Offer No Deposit Car Insurance Plans?

The availability of no deposit car insurance can vary by location and company policy. However, some insurers are known for offering flexible payment options or low upfront costs that can essentially act as no deposit insurance. These companies often include but are not limited to:

- Progressive

- Kemper Direct

- Esurance

- Infinity

- Erie

- Farm Bureau

- Travelers

- American Family

- Mercury

- USAA

- Auto-Owners

- Farmers

- State Farm

It’s important for consumers to actively inquire and compare offers from these and other insurers, as policies and promotions can change. Additionally, eligibility for very cheap car insurance with no deposit may depend on various factors, including the driver’s history, credit score, and the specifics of the insurance policy being sought.

Which Customers Qualify for Cheap No Deposit Car Insurance?

The likelihood of qualifying for very cheap car insurance with no deposit is significantly higher for individuals who present a lower risk to insurers. This category typically includes those with no prior at-fault accidents and no outstanding traffic tickets. Furthermore, a person’s credit score plays a crucial role; a higher score suggests a higher probability of timely premium payments, prompting insurers to offer more favorable rates.

Insurance premiums are fundamentally about assessing a driver’s risk potential. Generally, a clean driving record over a three-year span reduces the need for a down payment. Additionally, factors such as the number of miles driven monthly and the type of vehicle impact the insurance rates and the deposit amount required. For drivers with a positive record and those driving a used car, the deposit can range from as low as zero to about 33% of the annual premium, typically falling between $20 to $50.

However, the path to finding affordable car insurance can be challenging for high-risk drivers. Those with severe infractions, such as DUIs or multiple at-fault accidents, often face higher deposit requirements and increased premiums. Some insurance providers may even exclude drivers with a history of DUI or numerous reckless driving incidents.

The vehicle you choose to insure also influences the deposit needed. Newer, more expensive cars valued over $20,000, as well as financed or leased vehicles necessitating comprehensive coverage, generally carry higher deposits due to the greater overall premium costs. Consequently, opting for a used vehicle not under finance can be a strategic move for anyone seeking very cheap car insurance with no deposit requirement, particularly for those aiming to minimize initial financial outlays.

In summary, while securing no deposit car insurance is more accessible for drivers perceived as low-risk by insurance standards, options remain available for those categorized as high-risk. By gathering multiple quotes and opting for basic, less costly coverage, even drivers with adverse driving records or poor credit can find economically feasible insurance solutions. Prioritizing vehicles that do not demand extensive coverage further aids in reducing upfront costs, making no deposit insurance a viable option for a broad spectrum of drivers.

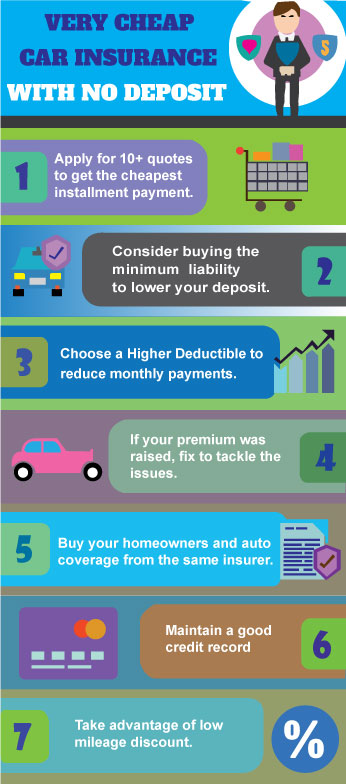

How to Get Very Cheap Car Insurance No Deposit

Obtaining very cheap car insurance without a deposit can be a streamlined process if you know where to look and what steps to take. Here’s a comprehensive guide on how to secure this type of coverage:

- Understand the Factors: The deposit and premium rates for car insurance can vary based on several factors, including the insurance company, your age, gender, the car’s status (owned, financed, or leased), your location, monthly driving mileage, driving record, credit rating, and whether you’re a homeowner or renter.

- Opt for State Minimum Liability: To keep your initial costs as low as possible, consider opting for a state minimum liability-only policy. Such policies often come with low or even zero deposit requirements, making them an ideal choice for those looking to save on upfront costs.

- Research and Compare Quotes: The advent of the internet has vastly simplified the process of comparing insurance quotes. The best way to find a plan that works for you is to compare 10 or more quotes. Utilize online platforms to compare multiple plans and review deposit requirements between insurers. Start your online quote by entering your zip code to get the cheapest insurance options available where you live.

- Monthly Payment Plans: If paying the entire premium upfront is not feasible, most insurers offer convenient monthly payment programs. This flexibility allows you to manage your finances better without compromising on coverage.

- Select a Payment Option: When applying for a quote, insurers will usually give you the option to pay in full, quarterly, or month-to-month. Assess your financial situation and choose the plan that best suits your needs. Be mindful of any deposit amounts quoted if the monthly premium is not paid in full.

- Consider Vehicle Choices: Your vehicle choice significantly impacts insurance rates and deposit requirements. Used vehicles not under finance generally have lower insurance costs. Expensive, newer cars, or those under finance or lease, typically require comprehensive coverage, which can increase the deposit amount. For instance, consider a 2012 Honda Accord insured by Progressive, which required a mere $5 deposit. The initial monthly payment was set at $109, with the total premium amounting to $1,232. Note how small the deposit was, just $5. Almost anyone can afford this amount, making securing coverage easy for those low on funds.

- Address Financial Obstacles: If high-risk factors are inflating your insurance costs—such as a poor driving record, DUIs, or a bad credit score—take steps to mitigate these issues. Lowering your risk profile can help reduce deposit requirements and overall premiums.

- Leverage Quote Comparison Tools: Online quote comparison tools can be invaluable in your search, allowing you to swiftly compare rates from dozens of providers. This can be particularly helpful if you’re in a financial pinch and need coverage with minimal upfront costs.

- First-Month Free Offers: Some insurers provide enticing incentives like first-month free car insurance to attract customers. If you meet specific basic requirements, you can get cheap car insurance with the first month free. While the premium might be slightly higher than that of competitors with low-down payment policies, such offers can significantly reduce your initial payment burden.

- Negotiate for Lower Deposits: Even if it seems challenging to find policies with deposits ranging from $5 to $20, don’t hesitate to negotiate or ask for adjustments. Insurers might have flexible options available, especially if you demonstrate loyalty or have multiple policies with them.

By following these steps and maintaining a proactive approach to managing your risk factors, you can successfully find very cheap car insurance without the need for a deposit. Remember, the key is to compare, research, and not shy away from negotiating to find the best deal that suits your financial situation and coverage needs.

Testimonials

Testimonial 1: Alex D.’s Insight

Alex was initially skeptical about the feasibility of finding very cheap car insurance without a hefty deposit. After diligently researching and comparing quotes, he successfully secured a policy that required no upfront costs. This straightforward process and the subsequent savings allowed Alex the financial flexibility to prioritize his spending, highlighting the value of very cheap no deposit car insurance.

Testimonial 2: Jamie P.’s Breakthrough

Facing the challenge of budgeting for auto insurance as a student, Jamie discovered the game-changing option of cheap no deposit car insurance. This discovery significantly relieved the financial pressure of obtaining necessary coverage, proving to be a pivotal moment in Jamie’s journey towards effective financial management and ensuring peace of mind with affordable coverage.

Final Takeaways

If you need instant coverage but have little or no cash, look for cheap car insurance with no deposit online. While not available from all insurers or in all states, with thorough research and a solid understanding of the qualifying criteria, finding a suitable policy is possible. It’s essential for potential policyholders to carefully compare offers, understand the terms, and consider the long-term costs associated with these types of policies.

Remember, the goal is to find comprehensive coverage that not only fits your immediate financial situation but also provides adequate protection on the road. While you might have to compare several quotes from different companies, don’t give up until you find the most affordable plan and a low or even no deposit requirement.

Very Cheap Car Insurance No Deposit

Compare Insurance Quotes and Save!

Secured with SHA-256 Encryption