Buy Now Pay Later Car Insurance

If you need to insure your vehicle and save money in the process, get “Car Insurance Now Pay Later.”

Compare Quotes in 2 Minutes

Powered by:

Secured with SHA-256 Encryption

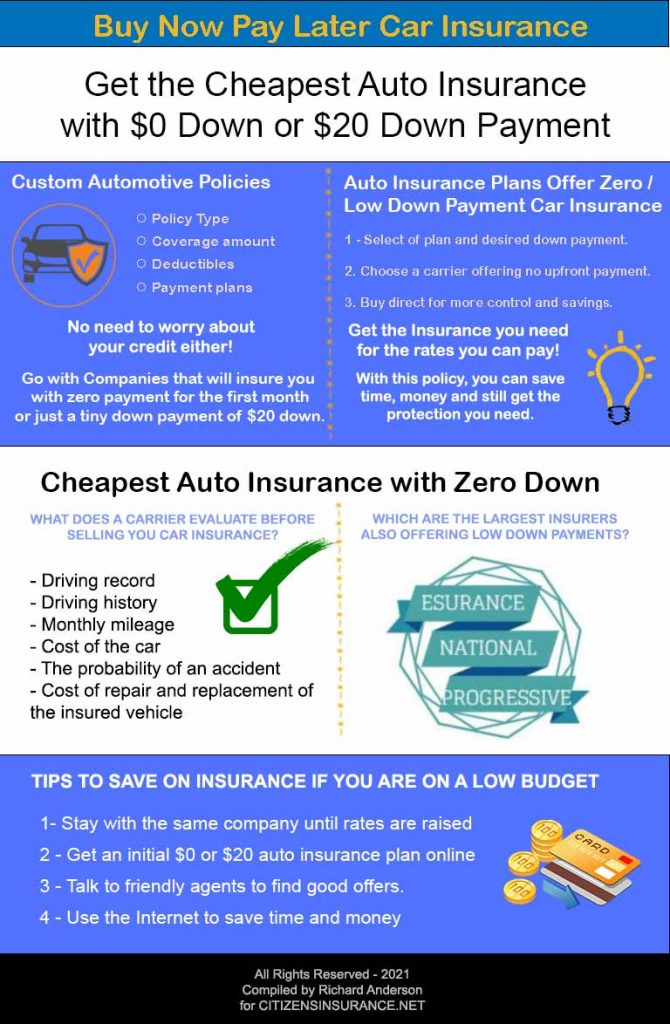

Almost all of us get into a financial bind from time to time and struggle to pay for basic necessities like auto insurance coverage. If you are short on funds but still need to get covered right away, consider a Buy Now Pay Later Car Insurance policy. It will allow you to get legal coverage and pay for your policy in monthly installment payments with a low upfront amount.

If you need to insure your vehicle and save the most money, then paying for the entire premium in one lump sum will save you the most. However, only some have enough money to go this route. Some in a financial crunch might have less than $100 saved up but still need to get their vehicle covered to go to work or school. This means finding a policy with the minimum deposit amount and monthly installment payments.

With a buy now pay later car insurance policy, you can get insured and covered the same day. You can often get legal auto insurance for less than $50 down if you have a clean driving record and a low-risk profile. A Buy Now Pay Later Car Insurance policy is an excellent option for those in-between jobs, low on cash, or just can’t afford to tie up their funds and need the cheapest car insurance possible for a few months.

Getting this type of policy might sound unreal since you usually should spend a significant sum securing auto insurance, including the deposit amount and first month payments. The good news for those who cannot afford to pay a huge amount of money in advance but also need to insure their vehicle immediately is that there are insurance providers who offer auto insurance coverage with no down payment.

Understanding Pay Later Car Insurance Plans

Need car insurance now pay later because you can’t afford to pay upfront? Don’t worry; buy now pay later car insurance plans have flexible payment arrangements that allow you to obtain the necessary insurance coverage for your vehicle without having to make a large upfront payment. Instead, you can choose to pay for your car insurance in installments over a specified period. This option provides a practical solution for individuals who require immediate coverage but prefer the convenience of spreading out the payments. By opting for pay later car insurance, you can ensure that you meet your insurance obligations while managing your budget effectively.

Getting The Best Auto Insurance Policy You Can Afford

You should always get enough car insurance coverage to protect you and your financial assets in the unfortunate event you get involved in an accident. This is crucial even when you decide on purchasing a buy now pay later car insurance policy. Getting car insurance with zero down payment is not a reason that justifies skimping on insurance coverage.

Always get enough coverage so that you have enough protection to cover property damages and medical costs if you are involved in a severe accident. Remember, the costs of accidents are going up, including medical care and the cost of repairing your vehicle. Get the highest amount of limits you can afford for the type of coverage you choose. In most cases, this means getting higher limits than a “bare bones” state minimum policy, which could leave you inadequately covered.

To compare no down payment plans, enter your zip code and fill out a quick application. It only takes about five minutes, and there is no obligation to buy a policy.

Buying collision and comprehensive coverage is a wise choice when you own a late-model automobile or have recently purchased a new car. This way, a claim payment should cover the entire cost of replacing your car if needed or, at least, most of it. In most instances, the added protection of comprehensive insurance coverage will cover you financially for the investment you’ve made in the vehicle.

Compare Quotes in 2 Minutes

Secured with SHA-256 Encryption

Should You Have Auto Insurance At All Times?

Driving with auto insurance is not only driving safely but also legally. Car insurance is mandatory in all states of the U.S. except for one. All drivers should have, at the minimum, liability insurance, according to their state laws. You could even be near bankruptcy, but you should never drive uninsured on public roads.

The consequences could be severe if you drive without insurance and get caught. When you have an accident and are held responsible for it, it usually results in hefty fines that you must pay.

Those drivers who cannot afford auto insurance due to lack of money could get a nothing-down auto insurance policy. In addition, your income could be seized, and a judge might order you to pay what you owe for the damages caused by the automobile accident. Not all insurance providers offer this option, but several providers do offer it.

Selecting The Best Type Of Coverage

You can choose from three kinds of coverage: liability, collision, and comprehensive coverage. You could purchase a liability-only policy if your car is not in good condition or if its value is low. This way, you will fulfill legal state insurance requirements, but you wouldn’t be fully protected in case of an accident. It’s smart, as stated before, to get higher limit coverage than state minimum requirements.

In today’s litigious society, protecting your assets is something you should consider when buying auto insurance. Drivers who own an automobile valued at $10,000 or more should purchase high-limits collision and comprehensive insurance coverage. This is also a wise choice for drivers with assets that need protection, such as investments or properties.

If you want to purchase a no down payment car insurance policy, you shouldn’t just buy the cheapest option you find. A good piece of advice is to keep full protection in mind and the less expensive plan. It would help if you first decided what coverage you need and what level of protection. Then, you are ready to compare quotes from different insurance providers. Also, always check for an insurer’s financial health at sites like A.M Best, which gives several grades for each licensed insurance company in the U.S.

Buy Now Pay Later Car Insurance Plans: Pros And Cons

You may be low on cash, and you want to purchase buy now pay later insurance. You might be starting a new job and waiting to receive your first check. In these situations, you could not afford the down payment of a normal policy. Perhaps the best choice for someone in this situation is to get a zero-down policy.

Some insurance companies offer an option: car insurance first month free no deposit. (You won’t pay the first month’s installment payment). Your insurance provider will split your premium costs into affordable monthly payments.

With first month free car insurance, you only need to make the required monthly payment, and you are good to go. For example, if your required installment payment is $65, then you’d only need to pay that amount, and your policy would become active.

This option could be helpful if you are facing a transitory financial crisis. Another plus to this arrangement is that monthly payments could be automatically deducted from your credit or debit card, which is an added convenience. Going this route will reduce the stress of possibly forgetting to mail in your payment each month.

There is only one significant disadvantage in case you decide on a buy now pay later car insurance policy. You won’t have to pay for the first month’s fee, but you will be paying more expensive premiums in the following months. The downside of this plan is that you would be charged an extra 5% to 10% and possibly more. So, the policy’s total cost will be more than if you paid the whole premium in advance.

What Insurance Companies Offer Zero Down Car Insurance Policies?

Several well-known insurance providers in the United States offer to buy now and pay later car insurance with no down payment. However, it’s important to note that not all providers offer these types of policies. Insurers that do include:

- All-State

- Esurance

- Farmers

- Geico

- Kemper

- Nationwide

- Progressive

- Safe Auto Insurance

- State Farm

States That Allows No Down Payment Car Insurance Policies

- Arizona

- California

- Florida

- Georgia

- Nevada

- New York

- Oklahoma

- Washington

Perhaps you don’t live in a state where no down payment car insurance policies are allowed. Well, there might be other affordable options. Some insurance providers could provide $20 down payment car insurance policies. You can search for low-deposit plans online. To get a free rate quote online and save money on your auto insurance coverage, start by entering your zip code.

Applying Online For First Month Free Auto Insurance

If you need car insurance now and pay later, it may be easier to get than you think.. In most cases, it will take up to five minutes of your time. All you need is a device using an internet connection, like a tablet or smartphone, and you can apply for free quotes online. Below you’ll find some of the basic questions you should answer when filling out a quote application.

- Make and model of your car

- Home address (the place where you will park the car)

- Driver’s license number

- Monthly mileage

- Driving record

- Type of coverage you want to get

- Amount of coverage you need

Tips To Save On Your Buy Now Pay Later Car Insurance

There are many things you can do to save more money when buying your car insurance. It would help if you were a safe driver and could drop unnecessary coverage. Bundling car and home insurance could also be beneficial for your pocket. The vehicle you drive could also affect the cost of your premiums. Keep reading below to know more.

1. Consider the Vehicle you Drive

Keep in mind that a more expensive car always needs more costly insurance coverage. Usually, the best rates come with average-valued four-door sedans older than five years. You could find a second-hand Toyota Camry, Chevrolet Malibu, and other similar four-cylinder vehicles in this group. On the other hand, convertible Porsche, Mercedes, and other new and expensive cars will be much more costly to insure.

Some insurance providers might want you to pay a large deposit for these kinds of vehicles when buying insurance. Remember to compare insurance rates before getting a new car. You could get online estimations of your car insurance premiums. There are a lot of websites that give you this in a blink.

2. Raise Your Deductible

You might be considered a safe driver if you have a driving record without accidents and ticket-free. Then, by increasing your deductible to $1000, you could save a lot of money. Your premiums could be 20% cheaper or even more. You could save up to $200 each year if you have a typical car insurance policy. Consider that you will need the deductible amount to file a claim after an accident. Therefore, save the deductible amount for a “rainy day.”

3. Drop Coverage You Don’t Need

How old is your car? Older than seven years? If that’s so, it should be depreciated by 50% or even more. So, you could be paying more for collision, and comprehensive coverage than your car is actually worth. For example, you could pay about $500 more each year for this broader coverage. If your vehicle is worth less than $10,000, consider canceling the collision and comprehensive coverage.

4. Bundle Home and Car Insurance

If you are a homeowner, you could deduct 5% of your policy’s price by bundling home and car insurance. You would be doing business with only one insurance provider, which is more accessible and better. You will notice the economic advantages of searching and comparing bundle quotes online.

5. Make The Most Of Discounts And Save Money

It’s wise to use all the available discounts to get the least expensive coverage possible. Some types of discounts may sound familiar, and others might be unknown to you. Here is a list of some of the most common:

- Safe Driver: You could save 25% or more with a clean driving record. Avoid tickets and traffic accidents.

- Low Mileage: You would save about 10% of your premiums, driving a low mileage (less than 800 miles every month).

- Good Student: Good grades in high school could save you around 15%. Keep a GPA of 3.0 or above.

- High deductible: With higher deductibles, drivers would save hundreds of dollars on their auto insurance premiums. Choose $1,000 or more as your deductible.

- Safety Features: You could be offered discounts from 3% to 5% when installing safety features. Get airbags, anti-lock brakes, GPS-based security systems, and others.

- Garage Parked: A garage for your car could knock about 2% off your premiums. Park your vehicle in a secure garage.

- Military and Veterans: There are discounts for members and veterans. If this is your case, you could save 5% or more.

Real Stories: The Flexibility of Buy Now Pay Later Insurance

Jamie’s Journey

Jamie, residing in San Antonio, TX, a freelance graphic designer, was navigating through tight deadlines and tighter budgets. The Buy Now Pay Later car insurance plan was a revelation, allowing Jamie to maintain essential car coverage without disrupting cash flow. This flexibility meant Jamie could focus on projects without the added stress of large insurance payments looming overhead. The deferred payment option provided a cushion that helped Jamie plan finances more efficiently, ensuring that insurance costs were aligned with income flow. This adaptability proved to be invaluable, giving Jamie the confidence needed to tackle projects without worrying about financial stability.

Final Takeaways on Buy Now Pay Later Car Insurance

There are many options for consumers that are low on funds to find great deals like Buy Now Pay Later Car Insurance. While not all insurers offer these deals and are not allowed in all states, you can still find affordable coverage with a low deposit if you shop around.

The first step for those who need car insurance now pay later is to compare as many quotes as possible. Use sites like this to quickly rate shop ten or more quotes and find the best rates for the coverage you need. Get started today and save more on the quality coverage you need.

Compare Quotes in 2 Minutes

Secured with SHA-256 Encryption