Hippo Insurance Company Review – 2025

Discover the essential details about Hippo Insurance. Uncover coverage, claims, and real user feedback. Make an informed decision now!

Compare Quotes in 2 Minutes

Powered by:

Secured with SHA-256 Encryption

Hippo Insurance at a glance

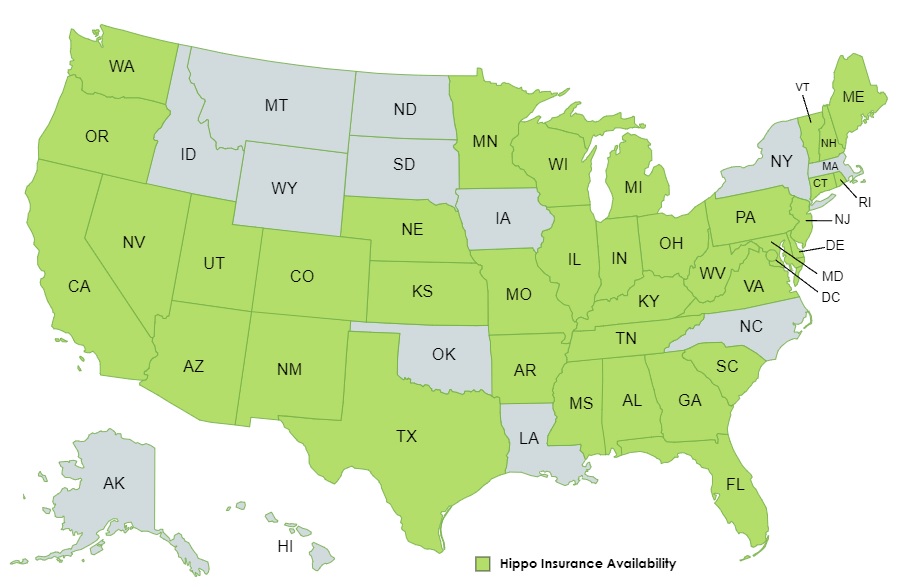

- Available in 37 states.

- Hippo is one of the leading home insurance providers.

- Standard policies are cheaper than competitors.

| Pros | Cons |

|---|---|

| Robust and enhanced coverage | Not available in all states |

| Very fast quote process | Only offers homeowners and condo insurance |

| Affordable premiums | No online claims filing |

| Dedicated customer support | Not rated by J.D. Power |

| 24/7 customer support |

A group of companies, including Hippo Insurance, focused on “insurtech,” or technology, to streamline the insurance process. Through easy online processes, customers can get a quote from Hippo in just 1 minute and a policy in a few minutes, but you cannot file claims online. Thus, Hippo emerged in 2015 with more profitable insurance for the insurer and more affordable for customers.

If you are looking for a home, life, and auto insurance package, Hippo is not the right company for you, as it only offers homeowners and condo insurance. However, Hippo insurance is a company that can cover most people's home insurance needs.

Some large insurance providers underwrite Hippo’s policies, influencing the cost of Hippo’s home insurance. Customers can take advantage of the company’s low home insurance rates combined with excellent coverage.

Compare Hippo homeowners insurance quotes by entering your ZIP code below.

Compare Quotes in 2 Minutes

Compare Insurance Quotes and Save!

Secured with SHA-256 Encryption

Hippo Insurance Company

Although Hippo has relatively few years in the insurance market, it is in an excellent financial position. This is because some insurance giants, including Spinnaker, TOPA, and Swiss Re, underwrite Hippo’s policies. It also influences the cost of Hippo insurance products. So, Hippo homeowners insurance options are often cheaper than their competitors in the insurance market.

The company provides the same amount of coverage as others, but their premiums are often below average regardless of your location.

The insurer does not have the traditional face-to-face structure used by other insurers, but the insured are highly satisfied with Hippo’s customer service. Hippo offers claims and customer service 24 hours a day, 7 days a week, by phone or email.

Hippo Home Insurance Availability

Hippo is proud to offer home insurance products throughout the country. This insurance agency offers its home insurance products in the following states:

Certain products, discounts, and coverages will be available depending on the state where you live.

In June 2020, Hippo made a huge deal by acquiring Spinnaker Insurance Company. This nationwide property insurance company is licensed in all 50 states, so Hippo will be able to expand its market.

However, Spinnaker will continue to operate independently while underwriting Hippo’s policies.

Hippo Home Insurance’s Partners

Customer Service

You can access Hippo’s customer service, available 24 hours a day, seven days a week, by phone or email. Contact details for sales, customer support, and claims are listed below.

Sales

(888) 617-0165

From 7 a.m. to 11 p.m. CT, 7 days a week

sales@hippo.com

Customer Support

(800) 585-0705

24/7 Service

support@hippo.com

Claims

(855) 999-9746

24/7 Service

claims@myhippo.com

Hippo Home Insurance Coverage

Hippo insurance offers standard coverages, including property, homeowners, and liability coverages. However, one advantage of Hippo is that its standard insurance policies contain forms of coverage that other insurers consider extra coverage. Below, we detail some of the most outstanding coverage options Hippo Insurance offers.

| Type of Coverage | Description |

|---|---|

| Dwelling coverage | Covers the costs of rebuilding or repairing the property in the event of a covered incident |

| Other structures coverage | Covers the repair and replacement of other structures on your property, like an attached garage or backyard shed, after a covered incident. |

| Liability and medical payments | In the event a guest is injured at your home, this coverage helps pay for settlements, legal fees, and medical bills. |

| This coverage covers up to $20,000 for damage caused by your sewer system overflowing or bursting pipes. However, this coverage is not the same as flood insurance which covers flood damage due to overflowing rivers or rain. | This type of coverage helps cover the full replacement of personal property and belongings after a covered accident. |

| Loss of use coverage | If a covered peril causes your home to become uninhabitable, this coverage pays for alternative housing, food, and travel while your home is being repaired. |

| Computers and home office coverage | Hippo offers coverage limits for home office equipment four times higher than other providers. While most insurance providers offer less than $2,000 for computer coverage, Hippo can pay $8,000 for repair or replacement. These unique coverages can be extremely valuable to anyone with high-end computers or home office equipment. |

| Equipment Breakdown | Hippo offers up to $100,000 coverage to repair and replace appliances damaged by electrical or mechanical failure. This is great coverage, especially if you have expensive appliances, including HVAC systems, televisions, and water heaters. |

| Jewelry and watches coverage | This coverage helps protect your valuable items, whether it’s a new purchase or a family heirloom, in the event of a covered incident. |

| Full replacement cost | This covers the total replacement cost of your personal belongings and not just their depreciated value in a covered incident. |

| Water backup coverage | This coverage covers up to $20,000 for damage caused by your sewer system overflowing or burst pipes. However, this coverage is not the same as flood insurance which covers flood damage due to overflowing rivers or rain. |

| Enhanced rebuilding coverage | Your home coverage will be increased by 25% if your home is damaged in a catastrophic event. |

| Local ordinance changes | This coverage can help cover the additional expenses generated if your costs are increased due to changes in local ordinances. |

Hippo Home Insurance Costs

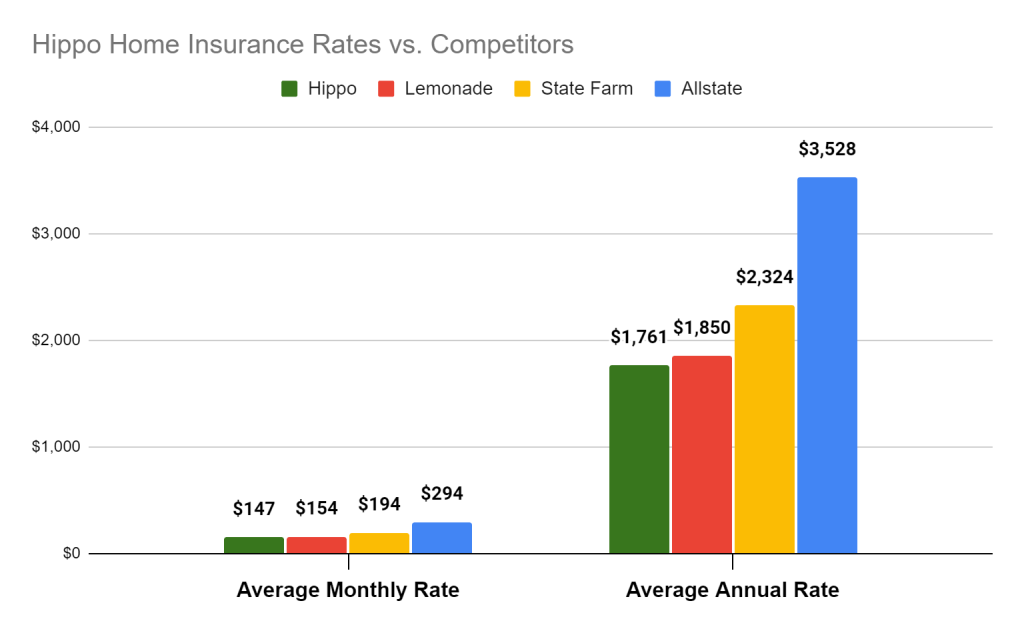

According to Hippo, its policyholders can save up to 25% on their home insurance premiums compared to the rates of other traditional home insurance providers. This may be due to the operational facilities provided by the company to obtain quotes and purchase a policy through a fully online process.

Our insurance specialists requested an annual quote from Hippo via email. We based our quote request on a 30-year-old first-time homeowner and developed a personalized quote of $69.58 per month or $835 per year. This value is below the national average cost for homeowners insurance.

If we compare Hippo Insurance quotes with other major insurance companies such as State Farm and Allstate, it can be said that the company offers competitive and affordable rates. Next, let’s see a comparative chart between the rates of these three companies.

However, it would be best if you kept in mind that the cost of premiums depends on a number of individual factors. Decisive among these factors are your credit score, the condition, and age of your home, its location, and the risk associated with your home. Your policy limits and the amount of coverage you choose also play a role.

Hippo Home Insurance Discounts

Although Hippo’s insurance rates are affordable, the company offers a variety of discounts. Other homeowners insurance providers commonly offer some of them, but other discounts are less common to find.

We’ve outlined the most significant Hippo homeowner discounts below, though remember that not all discounts are available in all states.

| Type of Discount | Description |

|---|---|

| New home discount | If you’ve already paid the mortgage in full on the home you’re insuring, you may qualify for a discount and save your money with Hippo. |

| Early bird | Receive a discount for purchasing a policy at least eight days before the expiration date of your previous policy. |

| Homeowners Association (HOA) | You can get a discount on your home insurance policy if you are a homeowners association member. |

| No mortgage | Multiple fire extinguishers in your home can earn you a discounted premium. |

| Fire extinguishers | If your home has security and safety features like burglar alarms, fire sprinklers, fire alarms, you may be eligible for this discount on your home insurance premium. |

| Smart home | If your home has security and safety features like burglar alarms, fire sprinklers, and fire alarms, you may be eligible for this discount on your home insurance premium. |

| Storm shutters | You’ll get reduced homeowners insurance rates by installing storm shutters to protect your home’s doors and windows from the onslaught of storms or hurricanes. |

| Protective devices discount | Hippo offers free smart home monitoring systems, plus up to 13% off your premium for activating the eligible member’s system. |

| Loss-free discount | If you have not filed insurance claims in a certain period. |

| Affinity discount | You can get a discount if you have membership in certain groups, organizations, clubs, and fraternities and buy your home insurance through this group. |

Homeowners Insurance Quotes

Hippo Home Insurance aims to deliver quick quotes to prospective policyholders. In fact, we were able to see that it’s possible to get a quote in one minute and purchase coverage in less than five. Customers can also quickly check if they qualify for Hippo Insurance discounts by adjusting coverage limits accordingly.

Quoting systems from big companies like State Farm or Allstate are not as fast and convenient as Hippo's.

To contact Hippo, customers can call the Hippo insurance phone number (800) 585-0705 or visit the Hippo Insurance website. To get a homeowners insurance quote on Hippo’s website, myhippo.com, you need to answer a few basic questions about yourself and the home you’re insuring. Enter your home address and click the “Quote in 60 sec” button to start. Try now and save time and money!

Hippo Insurance Reviews And Financial Strength Ratings

Hippo has a ton of positive home insurance reviews. This is because the company’s low homeowners insurance rates and quick response to claims positively influence customer reviews. Clients benefit from easy-to-obtain coverage and excellent customer service from Hippo agents. So, this more positive customer service experience leads to fewer Hippo insurance complaints.

A.M. Best, the most trusted credit rating agency for policyholders, evaluates the financial health of insurance companies. Hippo is rated A- or “excellent” with A.M. Best, meaning the moment the customer files a claim, the company is more likely to meet its financial obligations.

On the other hand, J.D. Power does not provide a customer satisfaction rating for Hippo, and customer reviews on third-party websites are mixed.

Since Hippo has been in the insurance market for a relatively few years, it does not have ratings with various agencies that measure creditworthiness and long-term financial stability. This includes Moody’s and Standard & Poor’s (S&P), where Hippo’s credit rating is not included.

However, you should note that Hippo is backed by three distinguished and financially lucrative insurers: Swiss Re, Spinnaker, and TOPA. The credit scores of these companies are excellent. For example, below are Swiss Re’s ratings offered by three rating agencies.

| Rating Agency | Rating |

|---|---|

| Standard & Poor’s rating | AA- |

| Moody’s Rating | Aa3 |

| AM Best | A- |

You can feel confident in securing your home with Hippo. It has solid financial backing that won’t disappoint you when you need it most.

Our Take On Hippo Homeowners Insurance

Hippo’s wide range of home insurance coverage, coupled with a technology-focused model that makes it easy to purchase a policy and request a quick quote, makes the company one of the leading home insurance providers.

Some policyholders may receive a loyalty discount from another insurer. In this case, they may be able to find higher rates with Hippo than their current rates. Overall, however, Hippo homeowners insurance rates are competitive and affordable. Their solid financial backing and quick response to claims make their clients feel secure after a home-damaging incident.

However, do not consider Hippo if you want to bundle car and home insurance coverage with a single provider, as Hippo only sells home insurance policies.

Either way, comparing Hippo Insurance quotes to other homeowners insurance companies is essential before deciding. Get a home insurance quote now by entering your zip code below.

Compare Quotes in 2 Minutes

Trusted For Over 25+ Years*

Frequently Asked Questions

Is Hippo homeowners insurance a good option?

Hippo’s main benefits are its convenient digital experience, affordable rates, and additional coverage options. You may not even choose a Hippo home insurance plan, but their quick quote process gives you a starting point to compare rates and discounts from other companies.

What coverage does Hippo home insurance provide?

Unfortunately, Hippo car insurance is unavailable as they only provide home insurance products. In addition to basic home coverages like liability, homeowners, personal property, and loss of use coverage, Hippo offers home office and computer coverage, backup water coverage, protection for local ordinance changes, and coverage for workers in your home included in the standard Hippo package. Hippo also offers various endorsements that can be added to the policy and expand your coverage.

What states is Hippo available in?

Hippo Insurance is available in most states. States in which the company does not operate are limited to Montana, Idaho, Wyoming, North Dakota, South Dakota, Iowa, Oklahoma, Louisiana, New York, North Carolina, Massachusetts, Alaska, and Hawaii. Additionally, the company plans to expand to all states, backed by home insurance giants that can underwrite nationwide policies.

Compare Quotes in 2 Minutes

Secured with SHA-256 Encryption