No Down Payment Car Insurance in Florida

Discover how no down payment car insurance works, and real options for drivers in the Sunshine State

Compare Quotes in 2 Minutes

Powered by:

Secured with SHA-256 Encryption

Auto Insurance rates in Florida have increased a lot in recent years. This has led many drivers to look for ways to save money, like getting no down payment car insurance in Florida. The reality is that for many Florida drivers, finding car insurance that doesn’t require a big upfront payment can make the difference between being able to buy a policy or not.

The phrase “no down payment car insurance” gets searched thousands of times every month, but it is also one of the most misunderstood and misused terms in the industry. Most people imagine a policy that allows them to start driving with absolutely nothing due upfront, the way some companies offer phones, appliances, or furniture with deferred payments. Car insurance simply does not work that way.

What No Down Payment Car Insurance Really Means

When insurers advertise “no down payment in FL” options, what they usually mean is that you only have to pay your first month’s premium. Traditional policies often require a lump-sum deposit or a percentage of the total premium – sometimes 10 to 25 percent – before the policy becomes active. But a no-down-payment plan strips that deposit away and lets the driver begin coverage by paying only the standard monthly rate.

This is not the same as paying nothing. It’s a structure where the insurer agrees to spread the cost over future months rather than collecting a large share upfront. Understanding this distinction helps you avoid false promises and focus on the insurers most likely to give you a legitimate low-upfront car insurance option.

Why This Matters More in Florida

Florida’s insurance environment makes the idea especially relevant because the state has some of the highest auto insurance prices in the country. PIP coverage alone drives up premiums, and dense urban areas such as Miami, Fort Lauderdale, Orlando, and Tampa push rates even higher because of traffic congestion, accident frequency, and historical fraud patterns.

When base premiums are high, the first-month payment is naturally higher too. So a no-down-payment policy in Florida doesn’t magically reduce the cost of insurance; it simply allows drivers to start coverage without an additional deposit beyond that first month.

Florida’s Insurance Requirements and How They Affect Your First Payment

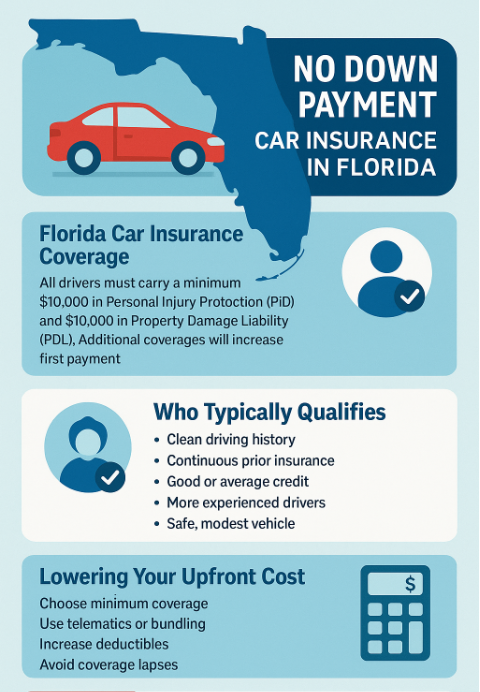

Before you can understand how to lower your upfront cost, it’s essential to know the coverage you’re required to carry. Florida law mandates that every driver maintain at least two specific coverages:

- Ten thousand dollars of Personal Injury Protection

- Ten thousand dollars of Property Damage Liability

These minimums form the foundation of every policy sold in the state. Although bodily injury liability is not legally required, drivers who skip it expose themselves to enormous financial risk if they cause an accident. Many choose to add it voluntarily, and lenders often require it if your car is financed.

The type of coverage you select directly influences your upfront cost. A driver who chooses only the minimum coverage will almost always pay less, both monthly and upfront, than someone who adds bodily injury protection, uninsured motorist coverage, collision, comprehensive, and medical payments. It’s not uncommon for Floridians with full coverage to pay two or three times the premium of someone choosing minimum coverage, and the first payment increases proportionally.

Because Florida follows a no-fault system, insurers must price policies knowing that PIP claims will be paid regardless of who caused the accident. This results in higher premiums and larger first-month payments. The more coverage you add, the more risk the insurer takes on immediately, and the more money they will want upfront to offset that risk. This is why your choice of coverage plays such a major role in whether you qualify for a no-down-payment structure.

Why Insurance Is So Expensive in Florida and Why That Matters For Upfront Costs

Car insurance in Florida is more expensive than in most other states, and the reasons go far beyond simple geography.

Florida has a unique combination of risk factors that insurers must account for every time they price a policy

- The state has some of the highest numbers of uninsured drivers in the nation, which increases the burden on insured drivers.

- The no-fault system encourages a high rate of PIP claims, many of which become expensive because of litigation, treatment disputes, and fraud.

- Add to that a dense population, crowded highways, tropical storm risks, and an active lawsuit culture, and it becomes clear why insurers charge more here.

These structural issues affect upfront payments because companies rely on initial premiums to offset risk. When the possibility of a claim is high on day one, insurers hesitate to allow customers to begin coverage without collecting something substantial. A first-month-only plan becomes a privilege offered to drivers who represent the least risk. For everyone else, insurers will often require some kind of deposit or a larger first payment to ensure financial stability and reduce cancellation risk.

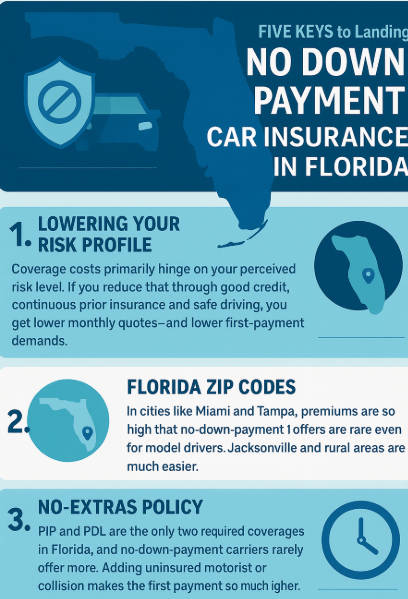

Drivers living in high-risk counties like Miami-Dade or Broward experience this more than anyone else. Even with a clean driving record, the area’s claim history inflates premiums to the point where a first-month-only arrangement is sometimes unavailable. That’s why no-down-payment policies are far easier to secure in places like Jacksonville, Tallahassee, or Gainesville compared to Miami or Fort Lauderdale.

How No-Down-Payment and Low-Down-Payment Plans Work in Florida

The way insurers structure their billing options varies, but most fall into a few familiar patterns. The least expensive and most sought-after structure is the first-month-only plan. This is the closest thing to true “no down payment” coverage because there is no extra deposit, just the first month’s premium. A second structure requires the first month plus a small deposit, which usually ranges between fifty and one hundred fifty dollars. A third structure asks for a percentage of the total six-month premium upfront.

Florida drivers who qualify for the first-month-only plan are typically those who exhibit low-risk characteristics. These include maintaining a clean driving history, having no recent coverage lapses, carrying a strong or average credit score, and living in a ZIP code that does not produce an unusually high volume of claims. Insurers also look at vehicle type because safer, older, or less valuable vehicles present a lower financial risk. A driver in a modest sedan with a long history of continuous insurance in a medium-risk ZIP code may qualify easily, while someone driving a new luxury vehicle with a recent lapse in coverage may not.

Understanding how payment structures work allows you to ask the right questions. Instead of simply requesting a quote, ask the agent what the amount due today would be under each structure. Some agents only present quotes that include a deposit, even though first-month-only plans exist for qualified applicants. When you know what to ask, you can uncover options that are not advertised directly.

Who Qualifies For Low Down Payment Plans in Florida

Eligibility for low upfront costs depends almost entirely on perceived risk.

- Insurers reward consistency, financial stability, and a clean driving record. Drivers who have maintained insurance without lapses, who pay their bills on time, and who avoid tickets or accidents are those most likely to qualify for the first-month-only billing option.

- Stable credit also plays a major role. Even though Florida does not allow insurers to use education or occupation as rating factors, credit remains a powerful indicator of reliability in the eyes of insurance companies.

- On the other hand, drivers with recent accidents, DUIs, coverage gaps, poor credit, or multiple violations face far steeper challenges.

- Florida’s urban ZIP codes also play a significant role. A clean driver in Miami may still be placed in a higher-risk tier than a moderately risky driver in Gainesville or Polk County simply because the surrounding area has a history of high accident and fraud rates. Insurers price policies neighborhood by neighborhood, not just state by state, and this impacts both monthly and upfront payments.

High-risk profiles usually require larger first payments because the insurer needs to protect itself against the possibility of early cancellation or immediate claims. Drivers who fall into this category can still reduce their upfront cost, but doing so requires a more tactical approach, which we will explore shortly.

How SR-22 and FR-44 Filings Affect Upfront Payments

Florida is one of the few states that uses the FR-44 insurance certificate, which is required after a DUI conviction. Both SR-22 and FR-44 filings serve as proof of financial responsibility, but FR-44 requires far higher liability limits. SR-22 filings are often required for violations such as driving without insurance, multiple minor offenses, or serious infractions. FR-44 filings are reserved for DUI and alcohol-related convictions, and because they require such high limits, they dramatically increase the cost of insurance.

These filings make it nearly impossible to secure a no-down-payment structure. An FR-44 policy in Florida often costs double or triple a standard policy, and insurers typically require a significant portion of the premium upfront. Some will only issue FR-44 policies on a six-month paid-in-full basis, meaning monthly payments may not be available at all. For drivers with an SR-22 filing, monthly payments are more common, but the upfront payment is still much larger than what a preferred-risk driver would pay.

The key to reducing upfront cost when dealing with SR-22 or FR-44 is to shop aggressively with companies specializing in high-risk customers. These insurers understand the financial difficulty of the situation and offer more flexible payment plans compared to major carriers. Still, even the most flexible high-risk companies rarely offer true first-month-only billing for these situations. The best strategy is to stabilize your record, maintain continuous coverage, and re-shop your policy once the filing period ends.

Realistic Cost Expectations for Florida Drivers in 2026 and Beyond

The cost of a no-down-payment policy varies widely depending on the driver’s age, location, driving history, and coverage selection. In Miami, a driver with a clean record might pay between two hundred sixty and three hundred forty dollars per month for full coverage, while someone in Jacksonville might pay one hundred sixty to two hundred thirty. In Orlando and Tampa, premiums tend to fall somewhere in between. A forty-five-year-old with good credit and a minor lapse in coverage might see monthly rates between one hundred fifty and two hundred fifty dollars, depending on location.

Younger drivers, particularly those in their late teens and early twenties, will face much higher costs. A twenty-two-year-old with a single speeding ticket may see premiums in Miami reach two hundred twenty to three hundred ten dollars for liability-only, and slightly lower figures in Orlando or Tampa. Meanwhile, a fifty-five-year-old driving a paid-off vehicle in Tallahassee may pay only eighty to one hundred thirty dollars per month.

The important thing to understand is that the first-month payment directly mirrors these monthly amounts. If you qualify for a first-month-only structure, the amount due today will simply be whatever your monthly premium is. If not, that figure will increase depending on the deposit required. These examples illustrate how location and personal history influence the payment structure you can access.

Insurers in Florida That Offer the Best and Lowest Down Payment Options

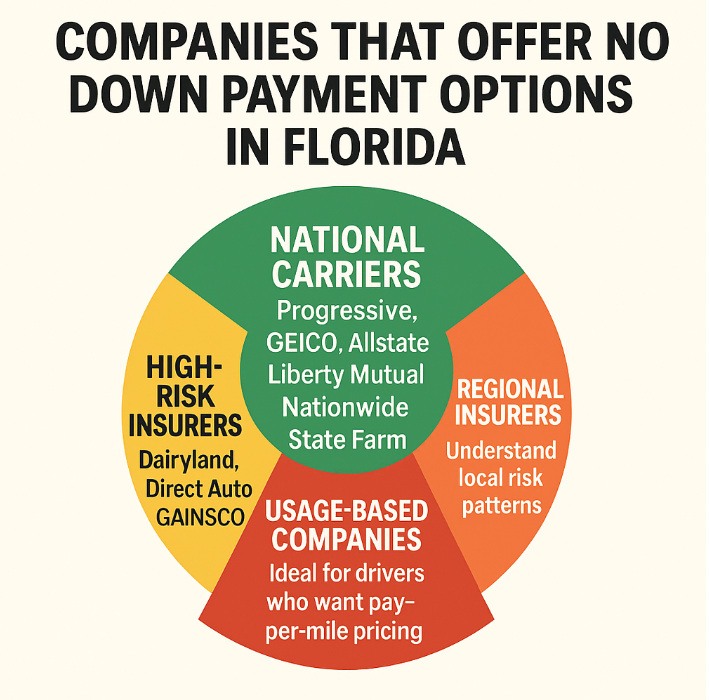

Some insurers are more willing than others to offer first-month-only plans. Large national carriers such as Progressive, GEICO, Allstate, Liberty Mutual, Nationwide, and State Farm often provide flexible options for drivers with good records. Although they rarely advertise no-deposit plans, their internal billing structures sometimes allow agents to set up policies that require only the first month to begin coverage.

Regional insurers that focus on Florida drivers can also offer competitive upfront arrangements because they better understand local risk patterns. Independent agents are the best resource for discovering these companies because they can access multiple carriers at once.

High-risk insurers such as Dairyland, Direct Auto, GAINSCO, and The General are more accessible for drivers with violations, DUIs, or poor credit. They may not always offer the lowest upfront cost, but they often provide more flexible payment plans for people who would otherwise be denied standard monthly billing.

Finally, companies offering usage-based or pay-per-mile car insurance appeal to low-mileage drivers who want to reduce both their monthly payments and their initial payment. Although these programs primarily help with long-term savings, they indirectly reduce upfront costs by lowering the overall premium.

🥇 Best Overall for Low Upfront Cost: Progressive

- ⭐ Most reliable insurer for first-month-only starts

- ⭐ Flexible underwriting helps more drivers avoid large deposits

- ⭐ Snapshot and other discounts may reduce the first payment immediately

- ⭐ Agents often choose Progressive when the goal is the lowest amount due today

The Overall Best Insurer For No Down Payment Car Insurance in Florida

When it comes to securing a true no-down-payment or first-month-only car insurance option in Florida, Progressive consistently rises as the strongest overall choice. While many insurers offer flexible billing in certain situations, Progressive has earned a reputation among agents and Florida drivers for being the company most willing to activate coverage with only the first month’s premium due. They do not advertise no-deposit policies, but their internal billing system makes it possible far more frequently than their competitors.

Progressive’s biggest advantage is the flexibility built into its underwriting model. The company evaluates drivers using a wide range of predictive factors, and it rewards signs of financial stability and safe behavior. Continuous insurance, a clean driving record, reliable payment history, and even simple steps like enrolling in electronic documents can help a Florida driver qualify for a first-month-only start. Because Progressive’s rating system is so adaptive, even drivers who aren’t perfect risks, such as those with an older ticket or average credit, often stand a better chance of securing a low-upfront structure with Progressive than with companies that maintain stricter, more traditional risk tiers.

Another reason Progressive stands out is its strong discount ecosystem. Programs like Snapshot allow safe and low-mileage drivers to reduce premiums early, sometimes immediately, which directly lowers the first payment. In a high-cost state like Florida, small reductions in monthly premiums make a noticeable difference at activation. This gives Progressive an edge over insurers whose discount programs take effect only at renewal.

Independent agents across Florida also prefer Progressive when a customer specifically asks for the lowest amount due today. Agents know exactly which inputs influence Progressive’s billing flexibility and can structure a quote so the driver has the best chance of avoiding a large deposit. This combination of flexibility, agent familiarity, and broad eligibility makes Progressive more accessible for drivers in high-risk ZIP codes, where securing a low-upfront policy is notoriously difficult.

Although GEICO, Liberty Mutual, Nationwide, and State Farm occasionally offer low-upfront options to highly qualified drivers, Progressive remains the most consistent choice. For Floridians who need to start a policy with minimal money upfront, Progressive almost always provides the best path to a manageable, first-month-only payment.

How to Reduce Your First Payment Step by Step

Lowering your upfront payment cost in Florida is entirely possible if you approach the process strategically. The most important step is to decide exactly what coverage you need before requesting quotes. If your goal is to minimize payment today, choosing only the required coverages, PIP, and PDL, will automatically reduce the insurer’s risk and make first-month-only billing more likely.

Gathering accurate information is equally important. In Florida, even small errors about your mileage, garaging address, or driving history can cause your quote to jump dramatically. Before you shop, verify your information, check your driving record if needed, and have your vehicle details ready.

Compare Quotes in 2 Minutes

Compare Insurance Quotes and Save!

Secured with SHA-256 Encryption

When comparing quotes, ask specifically for the amount due today. This reveals options that might not be offered automatically. Some insurers allow the deposit to be waived if you enroll in autopay or choose paperless delivery. Others reduce the first payment if you bundle renters or homeowners insurance, choose a higher deductible, or remove optional coverages like roadside assistance or rental reimbursement.

The more precise and well-prepared you are, the easier it becomes to uncover the billing structure you want. Insurers often reserve these options for drivers who display responsibility and stability, and demonstrating preparedness during the quote process can help signal those qualities.

How to Reduce Both Your First Payment and Your Long-Term Premium in Florida

Reducing your upfront cost is important, but lowering your long-term monthly premium is equally valuable. Raising your deductibles on collision and comprehensive coverage can significantly lower your monthly rate. If your vehicle is older or worth less than a few thousand dollars, you may not need full coverage at all, especially if you can afford to replace the car without relying on insurance.

Telematics programs can also produce immediate savings. These programs track driving behavior such as braking, acceleration, and time of day, rewarding safe habits with lower premiums. For many Florida drivers, a telematics program leads to discounts applied at the beginning of the policy rather than at renewal, which can help improve upfront cost as well.

Bundling renters’ or homeowners’ insurance with your auto policy is another effective strategy because many insurers offer up to twenty percent off when multiple policies are combined. Using a bank account rather than a credit card for payments can reduce fees or lower premiums further because insurers prefer payment methods that carry fewer processing risks.

Finally, never allow your policy to lapse. Even a short break in coverage can increase both your monthly premium and your upfront cost for years. Continuous coverage is one of the most powerful factors influencing whether a driver can qualify for low-upfront-payment options.

Avoiding Misleading Ads and Protecting Yourself From Scams

Florida’s insurance market attracts many deceptive marketing tactics that prey on drivers searching for low upfront costs. Ads that proclaim “everyone qualifies for $0 down car insurance” are almost always misleading. These promotions often lead to websites that collect personal information only to distribute it to numerous agencies, resulting in relentless calls and quotes that don’t match what was advertised. Other schemes involve fake agents offering instant no down payment insurance through mobile payment apps, only for the driver to discover later that no policy was ever issued.

To protect yourself, rely on insurers and agencies that openly identify themselves, provide clear written quotes, and explain the policy terms before asking for payment. A legitimate company always issues a declarations page immediately after binding coverage. When something seems unclear, overly promotional, or too good to be true, trust your instincts. The safest way to find a low-upfront policy is through reputable agents and established insurance companies.

Options for Teens and Young Drivers Seeking Low-Deposit Car Insurance in Florida

Young drivers in Florida face the highest premiums of any age group, which makes minimizing upfront costs especially challenging. Insurers see teens as statistically likely to be involved in accidents and therefore place them in higher-priced risk tiers. The simplest and most effective strategy for reducing costs is for a teen to remain on a parent’s or household member’s policy. This allows the teen to benefit from the household’s established insurance history and better credit profile.

Telematics programs can be particularly beneficial for young drivers because these programs reward safe behavior quickly. A teen who consistently drives safely may receive substantial discounts after only a few weeks, reducing the monthly premium and improving affordability over time. If a young driver must carry their own policy, the best approach is to drive a modest, practical vehicle with strong safety ratings. Also, the driver should maintain continuous insurance coverage and avoid any infractions that would elevate their risk profile.

Low Down Payment Options For Seniors and Retirees

Seniors are often among the easiest drivers to get affordable car insurance in Florida for under $100. Many seniors possess decades of clean driving history, low annual mileage, and stable credit, all traits insurers value highly. Because seniors often drive older, paid-off vehicles, they can choose liability-only protection without sacrificing financial security. This dramatically lowers both monthly premiums and the first-month amount.

Insurers also extend some of their most flexible billing structures to seniors because this group shows high loyalty and low cancellation rates. Seniors who take defensive driving courses, maintain good health, and avoid traffic violations are usually able to secure first-month-only policies with little difficulty. In many cases, seniors end up paying some of the lowest upfront costs of any demographic group in the state.

Smart Strategies For Florida Drivers With Bad Credit or Coverage Gaps

Drivers with poor credit or recent insurance lapses face an uphill battle when searching for low-down-payment policies. Insurance companies use credit as a predictor of claim likelihood, and gaps in coverage suggest instability. However, reducing upfront cost is still possible with a disciplined approach. Starting with a minimum-coverage policy helps lower the insurer’s risk immediately. Choosing an older vehicle without a lien makes it easier to avoid full coverage. Enrolling in autopay and telematics programs also helps establish reliability and can lead to better payment structures over time.

The key for this group is to maintain continuous coverage for at least six to twelve months. Once a stable payment record is established, drivers can re-shop their policy with more favorable companies and generally qualify for lower upfront payments. Every month of uninterrupted insurance helps rebuild trust with insurers.

Rideshare and Delivery Drivers in Florida

Drivers working for companies like Uber, Lyft, DoorDash, or Instacart must navigate unique challenges when seeking low-upfront-payment insurance. Personal policies often exclude commercial use, meaning a standard policy may not cover the driver when the rideshare app is active. Some insurers offer hybrid or rideshare endorsements that provide proper coverage without requiring a full commercial policy. These endorsements raise premiums but help prevent claim denials.

Because rideshare activity increases exposure, upfront costs are generally higher for these drivers. The best way to manage costs is to work with insurers that specifically offer rideshare endorsement programs. Reducing mileage during non-work hours, maintaining a clean driving record, and avoiding full commercial policies unless absolutely necessary can make a meaningful difference in both monthly and upfront payments.

Non-Owner Insurance: The Quietest Path to Low Upfront Costs

Non-owner insurance is an excellent solution for Florida drivers who need continuous coverage but do not own a car. These policies provide liability only coverage in Florida and typically cost far less than standard auto insurance. Because the insurer is not covering physical damage to a specific vehicle, the policy carries far less risk and can often be activated with the first-month-only payment. These policies are particularly useful for drivers required to file SR-22 documentation but who do not have a car. They allow the driver to maintain legal compliance and improve their risk profile while keeping costs manageable.

Should You Choose a No-Down-Payment Auto Insurance Policy in Florida?

Choosing a no-down-payment policy depends entirely on your financial situation and your long-term insurance goals. For drivers who need to activate coverage immediately with minimal expense, a first-month-only plan is an excellent solution. It provides instant legal compliance and allows you to get on the road without significant financial strain.

However, these policies can cost more in the long run. Drivers who can afford to pay more upfront may receive better discounts and avoid installment fees. The most financially efficient strategy is to pay as much upfront as you comfortably can, while still keeping your budget stable enough to avoid cancellation.

A policy with no deposit is ideal for drivers facing short-term cash flow challenges, moving for a job, or purchasing a new vehicle. But long-term financial stability often comes from paying a larger portion early when possible. Understanding your goals will help you determine whether this structure is right for you.

Frequently Asked Questions About No Down Payment Car Insurance in Florida

Many Florida drivers wonder whether it’s truly possible to secure car insurance without paying a deposit. While the answer is yes, it always comes down to qualifying factors such as credit, driving history, coverage choices, and the insurer’s internal risk model. Drivers also frequently ask whether credit influences upfront payment options, and the answer is overwhelmingly yes. Credit plays a major role in determining who receives the most flexible billing terms.

Another common question concerns government programs. Florida does not offer state-sponsored auto insurance assistance, so low-income drivers must rely on private insurers and strategic shopping. Drivers also ask whether SR-22 or FR-44 filings can be paired with no-down-payment plans. These situations almost always require larger upfront payments due to the high risk involved.

Understanding these common questions helps set realistic expectations and allows you to search effectively for the best possible plan.

The Final Word On No Down Payment Car Insurance in Florida

Getting a no-down-payment car insurance policy in Florida is possible for many drivers, but it requires a clear strategy. Choosing only the coverage you need, maintaining continuous insurance, driving a safe, modest vehicle, and keeping your record clean are the most reliable ways to qualify for first-month-only plans. Asking agents directly for the amount due today helps uncover options that many drivers never realize exist.

Florida is a challenging state for insurance, but with patience, preparation, and smart shopping, you can absolutely secure a policy that fits your budget, without sacrificing legal compliance or financial protection. Now that you know the reality of no down payment car insurance in Florida, the next step is to compare quotes. Get up to ten online quotes in under five minutes and save hundreds with direct rates.

Compare Quotes in 2 Minutes

Secured with SHA-256 Encryption