Dirt Cheap Car Insurance

Find dirt-cheap car insurance with tips on affordable rates, discounts, and smart strategies to save without compromising coverage.

Compare Quotes in 2 Minutes

Powered by:

Secured with SHA-256 Encryption

Are you sick and tired of your car insurance rates constantly going up? Today, more than ever, drivers are looking for dirt cheap car insurance. Rates are projected to go up over 15% next year, leaving many drivers with premiums they can’t afford.

Most drivers feel like they’re paying way too much to insure their car and want to find out how they can lower their coverage costs. In this article, we’ll break down eleven proven strategies to help you get the dirt cheap auto insurance you need and save you the most money.

How to Get Dirt Cheap Car Insurance

Let’s be real; car insurance isn’t exactly fun to shop for, but saving money on it is. The good news? You don’t need fancy tricks to slash your premium. Sometimes, it’s just about working the system the right way. Here’s how to score the cheapest rates without sacrificing too much (or ending up underinsured).

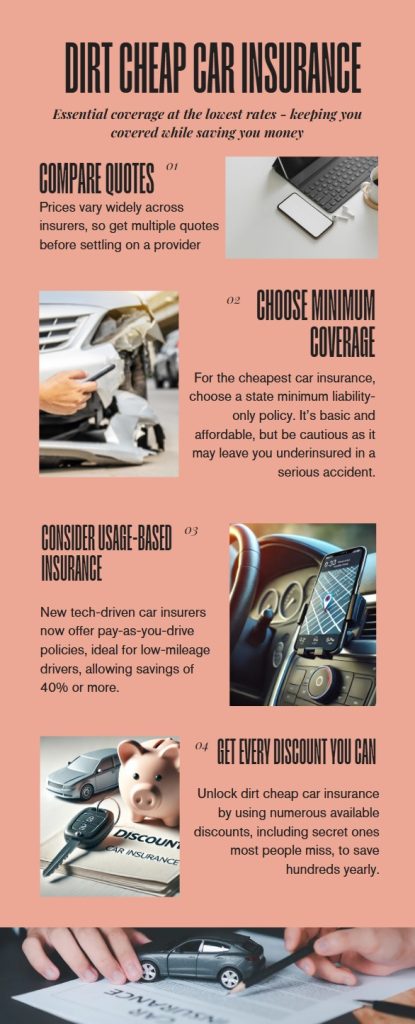

Compare Multiple Quotes

Rates vary wildly between insurers, often by hundreds of dollars. The easiest way to find the best deal? Today, it’s easier than ever to review ten or more car insurance quotes and see which insurer has the cheapest rates for the coverage you need. Good online comparison sites like our Citizens Insurance will let you compare up to ten rate quotes in only about five minutes. Don’t settle for the first offer; get a bunch of quotes and find your best rate. Remember, loyalty doesn’t always pay.

Compare Quotes in 2 Minutes

Secured with SHA-256 Encryption

Get State Minimum Liability Coverage

If you need dirt-cheap car insurance, a liability-only policy (your state’s bare-minimum coverage) is the cheapest route. Just be aware that you will likely be underinsured. If you cause a serious accident, you could be on the hook for way more than your policy covers. But if you’re in a cash crunch and need the cheapest rates, select a liability-only policy. Still, for safe drivers, rates can dip as low as $49/month.

QUICK TIP → Avoid leases: When you lease, you’re almost always required to buy a comprehensive auto insurance policy, which can cost 2X more than a liability-only policy costs.

Raise Your Deductible

Raising your deductible to $1,000 or more can earn you a nice discount of about 10%. Some insurers allow deductibles as high as $2,000, which can cut your premium even more. Just make sure you’ve got that cash stashed away in case of an accident and need to file a claim.

Drive Less and Save More

Insurers love low-mileage drivers. The fewer miles you drive each month, the lower your auto insurance rates will be. Stay under 800 miles/month, and you could snag a low-mileage discount of around 10%.

Consider a Pay-As-You-Go Policy

Thanks to technological advancements, the car insurance market is changing fast, with new and innovative competitors popping up. One popular trend is paying for only the miles you drive. This makes sense for people who don’t drive much or have a second vehicle they take out on weekends or special occasions. With a pay-as-you-drive policy, you can save 40% or more over traditional coverage. Compare several quotes from Hugo Insurance, Root, and Metromile to see which one is the cheapest for your needs. Compare Quotes in 2 Minutes Trusted For Over 25+ Years*

Drive an Older “Boring” Car

You can save big time on auto insurance by driving an older car that has a 4-cylinder engine and 4 doors, and good safety ratings. For example, if you get a used Hyundai Sonata, Toyota Camry, or Nissan Altima, that’s ten years old or older, you can save over 30% more than insuring a brand-new vehicle. Think about it, not only will you save on the vehicle purchase but hundreds a year on auto insurance.

QUICK TIP → Skip the sports cars: Stay away from high-performance sporty cars that are costly to repair and replace, like a Jaguar or Range Rover.

Be a Safe Driver

Just by staying accident and ticket-free, you can save about 15%. Most insurers offer generous safe driver discounts that you can renew year after year. If you get a ticket, make sure you go to traffic school so it does not go on your record for the next three years.

Keep your Credit Score High

The higher your credit score is, the lower your auto insurance rates will go. Insurers place more of an emphasis on a driver’s credit than ever before. Get your credit score above 650 and watch your rates go down.

Pay your Premium in Full

Most people prefer monthly auto insurance installment payments. However, if you’re looking for dirt-cheap car insurance, you must save all the money you can. Paying your premium upfront can earn you a solid discount of about 2%. You can also get discounts for paperless billing, typically 1%-3%, and even a discount for managing your policy completely online.

Get Every Discount You Can

You can use many discounts to save hundreds per year on your auto insurance coverage. There are also secret discounts most people don’t know about, which are listed below, that can help you save even more. Here are the best discounts:

- Multi-Policy Bundling Discount: If you own a car, multiple vehicles, and a home, you can save 5% or more by bundling policies. It’s also more convenient and easier to manage just one policy that covers everything.

- Safe Driver Discount: If you’re accident and ticket free then you can be rewarded with a nice discount of 10% and more.

QUICK TIP → If you do get a ticket just make sure you go to traffic school so it doesn’t go on your record for 3 years.

- Good Student Discount: Students with a GPA of 3.0 or higher can earn discounts of up to 20%. This is because good students are generally more responsible and get in fewer at-fault accidents.

- Paid-in-Full Discount: If you’re on the hunt for dirt cheap car insurance, paying your auto insurance premium in one lump sum can save you 1% to 2%. It’s also super convenient because you don’t need to worry about paying your premium for another 6 or 12 months.

- Loyalty Discount: If you stay with the same provider for several years you can earn a loyalty discount of around 5%.

- Low-Mileage Discount: If you drive less than 8,000 miles per year, you can qualify for a low-mileage discount of 5%-10%.

- Telematics-Based Discount: Some insurers like Progressive and Farmers offer discounts of 20% and more for safe drivers who install a telematics device.

- Anti-Theft Device Discount: Installing an anti-theft device, like a LoJack GPS tracker, can save you 5-10% on a comprehensive insurance policy.

- Military Discount: Active duty and veteran military personnel can receive discounts of about 5-15%. Some insurers like Geico give discounts of up to 15%, so if you’re in the military get a quote from Geico.

- Senior Citizen Discount: Drivers aged 55 or older can qualify for senior insurance discounts if they have a clean driving record and complete a certified driver safety course.

- Homeowner Discount: If you own your home you can save 2% to 5% on your auto insurance because homeowners are considered more responsible and less prone to taking risks while driving.

- Defensive Driving Course Discount: Completing a defensive driving course can save drivers of any age 5-10%, as it demonstrates improved driving skills.

- Distant Student Discount: If a student on your policy lives more than 100 miles from home and does not have access to the vehicle, you can save 10% to 20%.

- Paperless Billing Discount: Just by choosing paperless billing, you can instantly earn a nice discount of 1%-3%.

- Automatic Payment Discount: Setting up automatic payments from a bank account can also save you 1-3%.

- Eco-Friendly Vehicle Discount: If you drive a hybrid or electric car such as a Toyota Prius or Tesla, you can get a discount of around 5%.

- Accident-Free Discount: Most auto insurers offer discounts to drivers who remain accident-free for several years of around 5-10%, a great option for those seeking dirt cheap car insurance.

- Vehicle Safety Features Discount: If you have multiple safety features on your vehicle like curtain and front airbags, anti-lock brakes, or lane departure warnings, you can get a cool discount of 3-5%.

- Professional And Occupational Discount: There are several professions like teachers, doctors, and even engineers, that can earn you discounted rates of around 5-10%.

- Alumni Associations Discount: Several prominent insurers such as Geico and Liberty Mutual have partnered with major universities to offer alumni membership discounts of 5%-10%.

- Good Credit Discount: A high credit score above 700 can lower your premiums by up to 15%. Insurance carriers have extensive data that shows individuals with good credit are less likely to get into accidents and file fraudulent claims.

- Parked-in Garage Discount: Several large insurers including Geico, State Farm, Progressive, and Allstate offer discounts of up to 5% if you park your vehicle in a garage.

- Married Couple Discount: If you’re married, you can get a small discount of about 2% – 3%. Married drivers are considered more responsible and safer behind the wheel.

- Dashboard Camera Discount: Installing a dash cam in your vehicle is a smart move and it can also earn you a discount of up to 5%. Dash cams provide rock-solid proof in an accident and reduce fraud.

- Drop Unnecessary Coverage: Chances are that if you have a credit card you are already covered for rental car coverage and don’t need this additional coverage on your policy, so drop it. If you have a membership from AAA then you don’t need to buy towing coverage on your policy. Also, if your vehicle is now more than 10 years old and is worth less than $8,000 consider dropping collision coverage and get a liability-only policy.

The Final Word On Dirt Cheap Car Insurance

To get dirt cheap car insurance you need to take a strategic approach. Start by implementing as many tips outlined in this article as possible. This means comparing ten or more car insurance quotes, driving a used car, dropping unneeded coverage, and getting all the discounts you can, just to name a few.

Despite car insurance prices going up a lot over the past couple of years you can lower your auto insurance premiums and put more money back in your pocket. To compare quotes where you live, enter your zip code and fill out an online quote. It only takes a few minutes and you can save hundreds by comparing rates. Get dirt cheap car insurance coverage today and save more.

Compare Quotes in 2 Minutes

Secured with SHA-256 Encryption