Cheap Liability Car Insurance in NJ

Compare Quotes Today & Discover the Best Low-Cost New Jersey Auto Insurance Options.

Compare Quotes in 2 Minutes

Powered by:

Secured with SHA-256 Encryption

With rates rising for several years, many drivers in the Garden State are choosing cheap liability car insurance in NJ. New Jersey consistently ranks among the most expensive states in America for car insurance.

The average annual cost of liability auto insurance in New Jersey is $1,126 or $94 per month. The good news is that safe drivers with clean records who compare rates and get multiple discounts can save hundreds on their liability car insurance. For some drivers, they can even get their rates below $800 per year.

The truth is NJ’s high premiums reflect the risks of traffic congestion, theft, and frequent claims. With the right strategy found in this guide, you can still secure cheap liability car insurance in NJ without sacrificing essential coverage.

New Jersey’s Minimum Liability Laws

Every driver in New Jersey is legally required to carry liability insurance. However, NJ is somewhat unique compared to other states because it offers two types of mandatory policy structures: the Basic Policy and the Standard Policy.

Basic Policy

- $10,000 for bodily injury liability per accident (not per person)

- $5,000 for property damage liability per accident

- $15,000 Personal Injury Protection (PIP)

This option is cheaper but offers very limited protection. It’s best suited for drivers with minimal assets who are looking for the lowest possible premium. However, because liability limits are so low, you risk being underinsured in the event of a serious accident.

Standard Policy (Minimums)

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $25,000 property damage liability

- $15,000 PIP coverage

Most drivers choose the Standard Policy because it offers broader protection and more flexibility. Higher limits are also available and strongly recommended if you own property, have savings, or want stronger financial security.

Top 10 Cheapest Liability Car Insurance Companies in New Jersey

While rates vary widely depending on driver profile, these companies consistently rank among the most affordable for liability-only coverage in NJ:

Known for offering some of the lowest base liability premiums. Ideal for tech-savvy drivers comfortable managing policies online.

Offers strong telematics programs like Snapshot, rewarding safe drivers. Often lenient toward drivers with minor tickets.

Best for policy bundling with home or renters coverage and local agent service. State Farm’s NJ agent network provides personalized support.

Competitive for drivers with clean records. Good driver and multi-policy discounts make liability coverage affordable.

This regional insurer is often cheaper than national companies. Known for strong customer service and consistently low liability rates.

Popular in New Jersey, offering flexible payment options and competitive liability pricing.

Discounts for safe driving, students, and military members. Strong option for families with multiple cars.

Offers the SmartRide program, rewarding good driving habits. Great for bundling home and auto coverage.

Available only to military members and families. Consistently one of the cheapest insurers in New Jersey for liability coverage.

Competitive liability rates for members, plus roadside assistance benefits. A good value option for long-time NJ residents.

The Overall Best And Cheapest Liability Auto Insurer in NJ

🥇 Best Overall: GEICO Insurance

Cheapest average rates • Easy online management • Reliable service

- Lowest rates statewide for liability-only coverage

- Fast online tools for quotes and policy management

- Discounts for students, military, and safe drivers

- Financially strong and trusted nationwide

The overall cheapest and most accessible insurer for New Jersey drivers

For most drivers in New Jersey, GEICO consistently stands out as the overall cheapest and best option for liability-only coverage. GEICO’s rates are among the lowest in the state for drivers with clean records, and their online-first approach makes it easy to compare quotes, manage policies, and access discounts without relying heavily on local agents. Beyond affordability, GEICO offers solid financial stability, reliable claims service, and a wide range of discount programs that apply to students, military members, and safe drivers.

While regional carriers like NJM and Plymouth Rock sometimes beat GEICO in specific ZIP codes, especially for long-time residents, GEICO’s broad accessibility and consistent pricing keep it at the top of the list. For most New Jersey drivers, GEICO delivers the right mix of low cost, convenience, and dependable coverage.

🥈 Runner-Up: NJM Insurance Group

Local expertise • Excellent claims service • Family-focused coverage

- Regional strength: deep roots in New Jersey

- High satisfaction in customer service surveys

- Discounts for good students, safe drivers, and bundles

- Personalized approach for local policyholders

A trusted regional insurer delivering exceptional local value

While GEICO often takes the top spot for affordability, NJM Insurance Group (New Jersey Manufacturers) consistently earns runner-up status for liability-only coverage in the Garden State. Unlike many national carriers, NJM is a regional company with deep roots in New Jersey, giving it unique insight into local driving conditions and risk factors. That focus often translates into lower premiums for residents, particularly long-time policyholders and families with clean driving records.

NJM is also praised for its exceptional customer service and claims handling, ranking well above average in consumer satisfaction surveys. The company provides generous discounts for bundling, safe driving, and good students, making it especially attractive for households with multiple drivers. For many New Jerseyans, especially those in suburban and rural ZIP codes, NJM can offer a more competitive price while providing a more personalized, community-focused experience.

Why New Jersey Car Insurance Costs More

New Jersey ranks among the most expensive states for auto insurance, largely due to a combination of urban density, accident frequency, and medical coverage rules. Here are the biggest cost drivers:

- High accident frequency – New Jersey’s highways, such as the Garden State Parkway, NJ Turnpike, and I-95 corridor, are some of the busiest in the nation. More traffic leads to more crashes and higher claims.

- No-fault insurance laws – NJ is a no-fault state, meaning drivers must carry Personal Injury Protection coverage. This inflates costs compared to states without mandatory PIP.

- Urban theft and vandalism – Cities like Newark, Jersey City, and Paterson report higher car theft and vandalism rates, which insurers factor into premiums.

- Litigation environment – New Jersey’s liability settlement environment tends to be expensive, with lawsuits and medical claims driving insurer payouts higher.

- Population density – With over 1,200 residents per square mile, NJ is the most densely populated state in the country. More people and more cars equal more risk for insurers.

On average, liability-only coverage statewide costs around $1,000 to $1,200 annually. But in urban ZIP codes, premiums may be significantly higher unless you shop carefully.

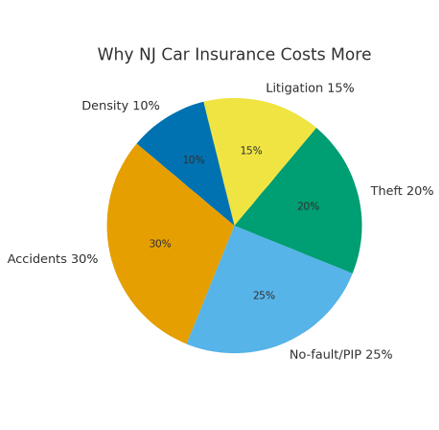

Factors Driving New Jersey Insurance Costs

| Factor | Approx. Contribution |

|---|---|

| High Accident Frequency | 30% |

| No-Fault / PIP Mandates | 25% |

| Theft & Vandalism | 20% |

| Litigation Environment | 15% |

| Population Density | 10% |

Liability Insurance for Teen Drivers in New Jersey

Adding a teenager to your auto policy in NJ can nearly double liability premiums. Teens are high-risk drivers, and insurers adjust rates accordingly. Still, there are strategies to reduce costs:

- Good Student Discounts – Teens who maintain a B average or higher qualify for reduced rates.

- Driver Training Courses – NJ-approved defensive driving classes can cut premiums.

- Telematics Monitoring – Programs like Progressive’s Snapshot or State Farm’s Drive Safe & Save reward safe driving behavior.

- Family Policies – Adding teens to a parent’s policy is always most cost-effective than separate coverage.

- Vehicle Choice – A modest, safe, reliable car keeps liability premiums down.

In New Jersey, companies like State Farm, Progressive, and NJM often provide the most competitive liability coverage for teen drivers.

Liability Insurance for Seniors in New Jersey

Seniors in New Jersey may face higher rates after age 70, as insurers factor in accident severity risks. However, many carriers provide targeted discounts:

- AARP Auto Insurance Program (The Hartford) – Senior-friendly policies with safe-driving rewards.

- AAA Northeast – Offers accident forgiveness and loyalty perks for long-term drivers.

- Defensive Driving Discounts – Seniors who take refresher driving courses can see liability premiums fall.

- Low-Mileage Discounts – Retired drivers who use their cars sparingly often qualify for reduced premiums.

Shopping every few years is especially important for seniors, since insurers weigh age differently. Seniors should also consider raising liability limits beyond the minimums to protect retirement savings and home equity.

Compare Quotes in 2 Minutes

Compare Insurance Quotes and Save!

Secured with SHA-256 Encryption

How to Save Money on Liability Car Insurance in New Jersey

Even within the same county, liability premiums can differ by hundreds of dollars. Smart shopping makes all the difference:

- Get at least three quotes on the same day to compare fairly.

- Bundle auto with homeowners or renters insurance for multi-policy discounts.

- Enroll in telematics programs if you’re a safe driver.

- Pay your premium in full instead of monthly installments.

- Maintain continuous coverage to avoid penalties and higher rates.

- Ask about affinity discounts for alumni associations, unions, or professional groups.

- Raise deductibles on optional coverages if you carry more than liability.

These tactics apply statewide, but they are especially useful in high-cost areas like Newark, Elizabeth, and Jersey City.

Common Pitfalls to Avoid When Insuring Your Vehicle In NJ

Chasing the cheapest rate sometimes leads drivers into costly mistakes. Here are pitfalls to watch for:

- Ignoring MVC compliance – If your insurer doesn’t properly report coverage to the NJ MVC, you may face penalties.

- Choosing the Basic Policy when you have assets – Minimum limits may leave you exposed after a serious accident.

- Forgetting SR-22 requirements – If you’ve had a DUI, major violation, or long lapse, you may need to file an SR-22 to prove coverage.

- Overlooking hidden fees – Some low-premium plans add processing charges that make them more expensive long-term.

FAQs About Liability-Only Auto Insurance in NJ

Drivers can choose between the Basic Policy ($10,000 bodily injury, $5,000 property damage, $15,000 PIP) and the Standard Policy minimums (25/50/25 liability, $15,000 PIP).

No. If your vehicle is registered in NJ, it must be insured or placed in an official non-use status with the MVC.

It depends on your profile, but GEICO, NJM, and USAA (if eligible) frequently rank among the lowest.

Usually not. It is far cheaper to add a teen driver to a parent’s policy.

Not always. Many insurers offer senior-friendly discounts, but comparison shopping is crucial.

The Final Word on Cheap Liability Car Insurance in New Jersey

While New Jersey is one of the most expensive states for auto coverage, cheap liability insurance is still possible with the right approach. By understanding NJ’s unique policy structures, shopping strategically, and taking advantage of discounts tailored for teens, seniors, and safe drivers, you can keep costs manageable without risking fines or underinsurance.

For most drivers, companies like GEICO, Progressive, NJM, and USAA, for those who qualify, consistently deliver some of the most competitive liability-only premiums in New Jersey.

Staying compliant with New Jersey law, protecting your financial future, and avoiding unnecessary costs all come down to smart shopping and continuous coverage. With the strategies outlined in this guide, you can secure cheap liability car insurance in NJ and also get the coverage that will protect you.

Find cheap liability car insurance in New Jersey today with a custom online quote. Compare quotes from multiple insurers through the Citizens Insurance comparison form, pick the right policy, and start saving hundreds on your New Jersey car insurance.

Compare Quotes in 2 Minutes

Secured with SHA-256 Encryption