Cheap Car Insurance in GA With No Down Payment

Learn how Georgia drivers can find affordable auto coverage with no upfront costs.

Compare Quotes in 2 Minutes

Powered by:

Secured with SHA-256 Encryption

Drivers looking to get their vehicle covered with the lowest out-of-pocket costs possible should consider cheap car insurance in GA with no down payment. Auto insurance is required in Georgia, but for many drivers in the Peach State, the biggest pain point isn’t the monthly bill; it’s the big down payment.

That’s why so many people search for more affordable options like “cheap car insurance in GA with no down payment.” This is one of the most-searched terms in the state for people looking for low-upfront-cost auto insurance.

Many drivers in GA want to get on the road today, without draining their bank account. But here’s the reality: under Georgia law, insurers must collect the first 30 days of coverage before activating a policy. That means “no down payment” doesn’t mean completely free to start. In reality, it means policies structured to minimize or finance the upfront cost.

This guide will show you exactly how to get the cheapest upfront car insurance options in Georgia, with real numbers, tables, and charts that explain your choices clearly.

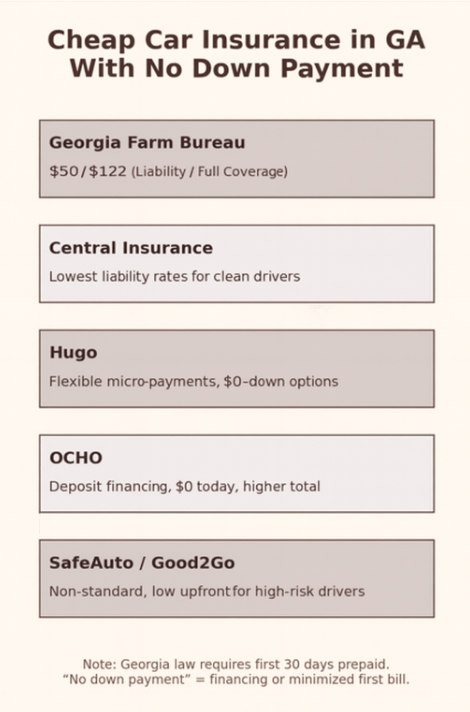

The Top 5 Cheapest Insurers in GA With No Down Payment

| Rank | Insurer | Avg Monthly Premium* | Why It’s Cheap/No Down Payment Option |

|---|---|---|---|

| 1 | Georgia Farm Bureau | $50 | Competitive local rates, trusted statewide. |

| 2 | Central Insurance | $56 | Lowest average annual liability premiums ($672/year). |

| 3 | Hugo | $60 | Known for micro-payment insurance, with real $0-down offers. |

| 4 | OCHO | Varies | Finance your deposit so you can start car insurance with $0 today. |

| 5 | SafeAuto / Good2Go | $70 to $90 | Non-standard carriers with low upfront plans. |

*Estimates based on liability-only coverage for good drivers; your rate will vary by age, location, and record.

Cheapest Car Insurance Company in GA With No Down Payment

Georgia Farm Bureau stands out as the most affordable option in Georgia for drivers seeking low or no-down-payment car insurance.

Liability-Only

Georgia Farm Bureau

$50/month

About $600/year

Low cost state-required coverage

Full Coverage

Georgia Farm Bureau

$122/month

About $1,464/year

One of the cheapest comprehensive protection in Georgia

Why Georgia Farm Bureau Is The Cheapest

- Local underwriting: Specialized policies for Georgia drivers help maintain low rates.

- Competitive liability pricing: Their liability-only rates consistently top affordability tables.

- Discounts and pay-in-full perks: Available savings reduce premiums even more.

No Down Payment Options And Details

While Georgia state law requires insurers to collect the first 30 days upfront, Georgia Farm Bureau offsets the impact by:

- Offering monthly installments with minimal down payment.

- Applying immediate discounts (like autopay, paperless billing, and multi-policy), which reduce the initial invoice.

- Georgia Farm Bureau offers no explicit “$0 down” product, but the combination of low monthly pricing and an upfront-affordable structure effectively mimics one.

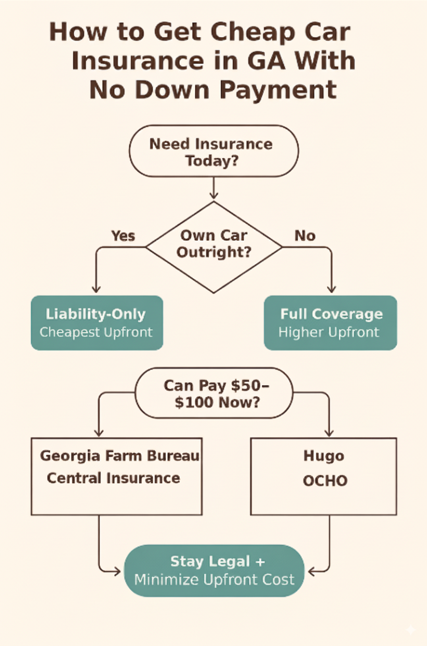

The Smartest and Cheapest Ways to Get Your Vehicle Covered In GA

A smart move when looking for the cheapest Georgia car insurance is to structure your policy the right way. Doing so can have a huge impact on the upfront cost. Here are several smart strategies that actually work:

1. Choose liability-only if you own your car outright.

2. Quote with multiple carriers — rates vary widely even within the same ZIP code.

3. Stack discounts: autopay, paperless billing, safe driver, and bundling discounts.

4. Opt for monthly installments.

5. Consider deposit financing if you truly need $0 down.

6. Bind new coverage before 10 days if your policy lapses, to avoid reinstatement fees.

Payment Options Compared

| Option | Pros | Watchouts |

|---|---|---|

| Annual | Lowest overall cost | Requires $1,800+ upfront |

| Semi-annual | Lower than annual | Still a large upfront bill ($900+) |

| Monthly | Lowest upfront cost | Installment fees, lapse risk |

| Financed | $0 today is possible | Higher total cost |

| Pay-as-you-drive | Savings for safe drivers | Not all drivers save |

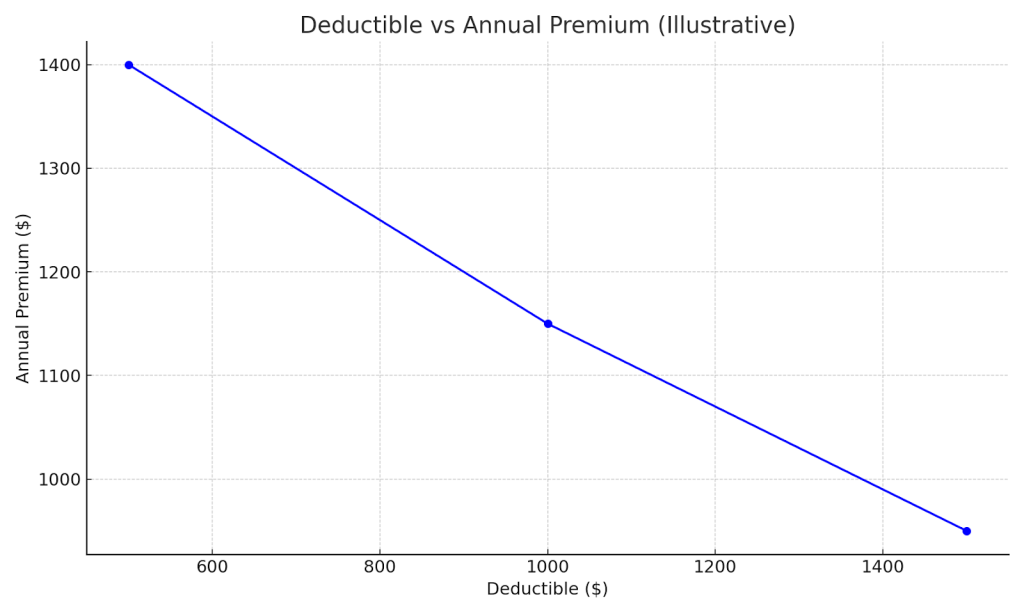

Deductibles and Premiums

One of the most effective ways to get cheap car insurance in GA with a low down payment is to lower both your monthly bill and upfront cost by choosing a higher deductible.

Georgia Rates Vary By City And Region

Car insurance isn’t one-size-fits-all in Georgia. Where you live impacts your upfront and monthly costs. The truth is, auto insurance in larger cities will cost more than in rural areas. Also, in areas prone to natural disasters, like coastal cities in GA, rates will be higher.

• Atlanta Metro: Higher accident and theft risk equates to higher premiums.

• Savannah/Coastal: Storm and flood risk raises comprehensive coverage costs.

• Rural Counties: Fewer accidents but more deer collisions.

• College Towns: Younger driver mix pushes premiums higher.

Georgia Auto Insurance Coverage Amounts To Consider

| Coverage Component | Minimum | Recommended |

|---|---|---|

| Bodily Injury (per person) | $25,000 | $50,000–$100,000 |

| Bodily Injury (per accident) | $50,000 | $100,000–$300,000 |

| Property Damage Liability | $25,000 | $50,000–$100,000 |

| Uninsured/Underinsured Motorist | Not req. | Match liability limits |

| Medical Payments | Not req. | $1,000–$5,000 |

| Collision | Not req. | If financed or valuable |

| Comprehensive | Not req. | If theft/storm risk is present |

Georgia Lapse Penalties

| Offense | Lapse Fine | Reinstatement Fee | Total |

|---|---|---|---|

| First | $25 | $60 | $85 |

| Second | $25 | $60 | $85 |

| Third+ | $25 | $160 | $185 |

Case Studies Of Three 3 Georgia Drivers

Atlanta Student (22 years old)

Jasmine is a college student in Atlanta who relies on her car to commute between classes and a part-time job. When her old policy expired, she needed affordable coverage immediately, but couldn’t afford a large down payment. After comparing quotes, Jasmine found that Hugo offered her liability-only coverage with a $1,000 deductible. Her first payment was just $155, compared to $220 from a mainstream national insurer. That $65 difference meant she didn’t have to borrow from her parents to get insured. She also signed up for autopay and paperless billing, which lowered her monthly cost even further. For Jasmine, the ability to start cheap and stay legal without tapping into emergency savings made Hugo the right choice.

Albany Senior (65 years old)

Robert, a retiree in Albany, drives fewer than 6,000 miles per year. While he had the option of paying monthly, he chose a semi-annual plan with Georgia Farm Bureau, paying $880 upfront. This decision saved him roughly $140 per year compared to the monthly billing option, thanks to lower installment fees and a small pay-in-full discount. Because Robert had the savings available and preferred predictable costs on his fixed retirement income, the larger upfront payment was worth it. For him, minimizing the total annual spend mattered more than the size of the first check, and the semi-annual structure kept his policy hassle-free.

Savannah Rideshare Driver

Marcus, a full-time rideshare driver in Savannah, faced a crisis when his previous policy lapsed. Without proof of active insurance, he would have been locked out of his rideshare platform, losing his primary source of income. To stay on the road, Marcus turned to OCHO, which financed his initial deposit so that he paid $0 at checkout. Over the course of the year, this added about $120 more in total costs compared to a standard monthly plan. But for Marcus, the trade-off was worthwhile: avoiding a lapse meant keeping his job and avoiding reinstatement penalties that could have cost him far more. For drivers in similar situations, financing a deposit can be the difference between staying employed and losing crucial income.

FAQs

A: Not directly. Financing companies make $0 down payment possible by fronting your deposit.

A: No. GEICS is the official verification system.

A: Some insurers offer a short grace period, but a lapse will cost more in fines and reinstatement fees.

A: 25/50/25 liability coverage.

A: Yes, premiums drop significantly with higher deductibles.

A: These filings are required after serious violations. They make $0 down nearly impossible and raise premiums.

The Final Word On Cheap Car Insurance In GA With No Down Payment

There’s no magic loophole to get car insurance in GA with nothing down. The reality is, Georgia requires insurers to collect the first 30 days upfront. But that doesn’t mean you’re stuck with huge bills. The cheapest paths are:

• Liability-only if possible.

• Monthly installments for minimal upfront cost.

• Higher deductibles to lower premiums.

• Deposit financing for $0 down (though more expensive long-term).

• Never let coverage lapse — it costs more than any deposit savings.

By knowing which insurers like Farm Bureau, Central, Hugo, OCHO, SafeAuto, and Good2Go actually offer the lowest-cost entry, you can get back on the road today without draining your bank account and stay legal under Georgia law.

Now that you know how to get cheap car insurance in GA with no down payment, it’s time to compare rates. Compare free auto insurance quotes online in minutes. Save hundreds today with direct rates.

Compare Quotes in 2 Minutes

Secured with SHA-256 Encryption