Non-Owner Car Insurance in Texas

Learn how non-owner car insurance works in Texas, when you need it and average costs.

Compare Quotes in 2 Minutes

Powered by:

Secured with SHA-256 Encryption

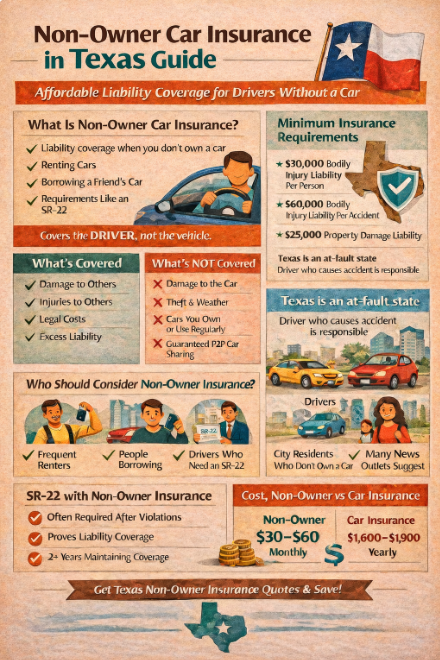

Non-owner car insurance in Texas is a low-cost way to carry legally valid liability coverage when you don’t own a vehicle but still drive occasionally. It’s commonly used by people who borrow cars, rent vehicles, live in large cities where ownership isn’t necessary, or want to avoid an insurance lapse that can push future premiums higher.

Texas is an at-fault state. That means the driver who causes a crash is generally responsible for the injuries and property damage they cause. For drivers who don’t own a car, non-owner coverage can be the simplest way to stay protected against lawsuits and major out-of-pocket costs without paying for full coverage on a vehicle.

What Non-Owner Car Insurance Is and How It Works in Texas

Non-owner car insurance is a liability-focused policy that follows the driver rather than a specific vehicle.

If you cause an accident while driving a car you don’t own, and you have permission to use it, your policy can help pay for the other person’s losses.

Most non-owner policies in Texas include bodily injury liability and property damage liability. Bodily injury liability helps cover injuries you cause to others, including medical bills, lost income claims, and legal defense if you’re sued. Property damage liability helps pay for damage you cause to someone else’s vehicle or property, such as a fence, building, or parked car.

In many situations, the vehicle owner’s insurance is primary. If the claim exceeds the owner’s liability limits, your non-owner policy may provide secondary or excess coverage depending on the policy terms and the circumstances of the crash.

Texas Minimum Car Insurance Requirements

Texas requires drivers to carry minimum liability coverage commonly described as 30/60/25. That means $30,000 of bodily injury liability per person, $60,000 per accident, and $25,000 of property damage liability per accident.

These minimums are the legal baseline, not a guarantee you’re financially safe. Medical bills and vehicle repairs can exceed these limits quickly in serious collisions, especially in higher-cost metro areas. Many drivers choose higher liability limits even on a non-owner policy to reduce the chance of being personally exposed.

The Top 5 Non-Owner Car Insurance Companies in Texas

Choosing the right non-owner car insurance company in Texas comes down to three things: availability, price, and whether the insurer can handle Texas-specific needs like SR-22 filings. Not every insurer offers non-owner policies in Texas, and even fewer do so competitively. The companies below consistently stand out for Texas drivers who don’t own a vehicle but still need reliable liability coverage.

State Farm

State Farm is often one of the strongest choices for non-owner car insurance in Texas, especially for drivers with clean or moderately clean records. The company has an extensive agent network across Texas, which makes it easier to get non-owner coverage that isn’t always visible online. State Farm is known for competitive pricing on liability-only policies and is frequently among the cheapest options for non-owner insurance in Texas. It also supports SR-22 filings, making it a solid option for drivers reinstating a suspended license. For Texans who prefer face-to-face service or want help navigating coverage details, State Farm is a dependable choice.

GEICO

GEICO is a popular non-owner insurance option in Texas due to its affordability and ease of access. While non-owner policies often require a phone call rather than an online quote, GEICO remains one of the most competitive national insurers for liability-only coverage. Texas drivers who rent cars frequently or borrow vehicles occasionally often choose GEICO for its straightforward policy structure and strong financial backing. GEICO also offers SR-22 filings in Texas, making it a practical option for drivers who need proof of financial responsibility without owning a car.

Allstate

Allstate is a well-known name in Texas and can be a good option for non-owner insurance, depending on location and driving history. While Allstate is sometimes more expensive than other insurers for standard auto policies, its non-owner rates can be competitive for certain drivers, particularly those with stable records. Allstate’s agent-based approach can be helpful when dealing with non-owner coverage details, policy exclusions, or SR-22 requirements. For Texas drivers who value customer service and want personalized guidance, Allstate is worth comparing.

Progressive

Progressive is often the go-to insurer for higher-risk Texas drivers seeking non-owner coverage. The company is known for flexibility, particularly when it comes to drivers with past accidents, tickets, or SR-22 requirements. Progressive frequently offers non-owner policies when other insurers decline, which makes it a strong option for drivers rebuilding their insurance history. While pricing can vary widely based on risk factors, Progressive remains one of the most accessible choices for non-owner insurance in Texas.

Dairyland Insurance

Dairyland specializes in non-standard auto insurance and is often overlooked, but it can be a valuable option for Texas drivers who struggle to qualify elsewhere. Dairyland commonly works with drivers who need SR-22 filings, have multiple violations, or have experienced insurance lapses. While premiums may be higher than for clean-record drivers, Dairyland’s willingness to insure higher-risk profiles makes it an important option for non-owner coverage in Texas.

Compare Quotes in 2 Minutes

Compare Insurance Quotes and Save!

Secured with SHA-256 Encryption

How to Choose Among These Insurers

The best non-owner car insurance company in Texas depends on your driving record, whether you need an SR-22, and how often you drive. Clean drivers should start with State Farm or GEICO. Drivers with violations or reinstatement requirements often find better luck with Progressive or Dairyland. Comparing at least three quotes is the best way to find the right balance of price and coverage.

Personal Injury Protection in Texas

Texas isn’t a no-fault state, but it does handle Personal Injury Protection (PIP) differently than many states. In Texas, PIP is commonly included on auto policies unless it is rejected in writing. PIP can help cover medical expenses and lost income for you and your passengers, up to the policy limit, regardless of who caused the crash.

For non-owner insurance, PIP availability and how it’s structured can vary by insurer. Some carriers may offer PIP on non-owner policies; others may not. If PIP matters to you, ask directly while quoting and get the answer confirmed before you buy.

Who Should Consider Non-Owner Car Insurance in Texas

Non-owner insurance is usually a good fit when you drive, but you don’t own a vehicle.

It’s especially useful for frequent renters who want consistent liability protection without relying on rental counter add-ons each trip. It can also help people who occasionally borrow a friend’s or family member’s car, especially if they want extra protection beyond the owner’s limits.

Non-owner insurance is also popular for maintaining continuous coverage. If you go without insurance for months, insurers can treat that as a higher risk later and charge more when you finally buy a standard policy again. A non-owner policy can help keep your insurance history active while you’re between vehicles.

It’s also a common solution for drivers who need an SR-22 but do not own a car. In those cases, a non-owner policy may help you meet reinstatement requirements without having to buy and insure a vehicle.

What Non-Owner Car Insurance Does Not Cover

Non-owner car insurance is not full coverage. It has important limits.

It usually does not cover damage to the car you are driving, because it does not include collision coverage. It also typically does not cover theft, vandalism, hail damage, flood damage, or storm-related damage to the vehicle, because those are comprehensive-type claims tied to the vehicle.

Non-owner policies usually do not apply to vehicles you own. They also may not apply if you have regular access to a specific vehicle, such as a household car you drive frequently.

Coverage can also be unclear with peer-to-peer car-sharing platforms. If you drive through services like Turo, you should verify coverage with both the platform and your insurer because some personal policies exclude peer-to-peer arrangements.

SR-22 in Texas and Non-Owner Insurance

Texas uses SR-22 filings to monitor certain high-risk drivers. An SR-22 is not a special type of insurance. It’s a form filed by your insurer that proves you’re carrying the required liability coverage.

Texas SR-22 requirements can be triggered by events such as driving without insurance, serious violations, certain convictions, or court judgments. In many cases, the SR-22 requirement lasts around two years, assuming you keep the policy active without lapses.

A non-owner policy can often be used to satisfy SR-22 requirements if the insurer offers SR-22 filing on a non-owner plan. If you need SR-22, it’s critical to avoid any lapse, because even a short cancellation can restart the requirement period.

Cost of Non-Owner Car Insurance in Texas

Non-owner insurance is usually much cheaper than insuring a car because it’s liability-only and doesn’t include collision or comprehensive coverage.

For clean-record drivers, non-owner insurance often falls in a practical range of roughly $30 to $60 per month. Drivers with accidents, tickets, DUIs, or SR-22 requirements typically pay more. Rates also vary by city, ZIP code, and liability limits.

Texas is large, and pricing can differ significantly between metro areas and smaller towns, so comparing multiple quotes is essential.

Compare Quotes in 2 Minutes

Compare Insurance Quotes and Save!

Secured with SHA-256 Encryption

How to Get Non-Owner Car Insurance in Texas

Buying non-owner car insurance usually takes a phone call, but the process is straightforward.

Gather your driver’s license details and be prepared to discuss your driving history. Tell the insurer you need non-owner coverage and mention SR-22 requirements immediately if you have them. Choose your liability limits, then ask whether the policy can include PIP if that matters to you.

Get at least three quotes. Prices can vary dramatically between insurers for the same limits. Once you choose a policy, proof of coverage can typically be issued quickly, and if you need an SR-22, the insurer can usually file it as part of the setup.

Additional Tips for Purchasing Non-Owner Coverage

Be accurate about your driving pattern and whether you have regular access to a vehicle. Misstating this can lead to denied claims or policy cancellation.

If you’re filing SR-22, avoid any cancellation or missed payment. Maintaining continuous coverage is essential.

Consider higher liability limits than the minimum if you have assets, a higher income, or want meaningful protection. In Texas, lawsuits after serious crashes can get expensive quickly.

Re-shop annually. Even small improvements in record or credit factors can lower rates.

Frequently Asked Questions About Non-Owner Car Insurance in Texas

Is non-owner car insurance required in Texas? ▼

Can a non-owner policy satisfy SR-22 requirements in Texas? ▼

Does non-owner insurance include PIP in Texas? ▼

Can I use non-owner insurance for rental cars in Texas? ▼

Is non-owner insurance cheaper than regular car insurance? ▼

The Final Word on Non-Owner Car Insurance in Texas

Non-owner car insurance is a practical, affordable way to stay insured in Texas when you don’t own a vehicle but still drive occasionally. It helps you meet Texas liability rules, reduces the risk of fines and license problems, and protects you from financially devastating lawsuits if you cause a crash.

If you want the best value, compare multiple insurers, choose liability limits that truly protect you, confirm whether PIP is available if you want it, and handle SR-22 requirements carefully so you don’t trigger extra penalties.

If you want, I can now expand this to a full 1,900 words by adding Texas-specific city cost patterns, a stronger “best insurers” comparison section, and a more detailed SR-22 reinstatement walkthrough, while keeping this exact formatting style. Compare non-owner car insurance quotes in Texas in under five minutes. Get covered today for less with direct rates.

Compare Quotes in 2 Minutes

Secured with SHA-256 Encryption