Lemonade Insurance Company Review – 2025

Determine if Lemonade Insurance is the right place for you to insure your assets, including your pets.

Compare Quotes in 2 Minutes

Powered by:

Secured with SHA-256 Encryption

Although Lemonade has only been in the insurance market for a few years compared to other large companies, it has become a strong competitor primarily in the property/casualty insurance sector. This is due to its affordable rates and user-friendly mobile app. It has a totally digital platform which makes it a unique approach towards those who do not like the experience of buying their policy by going to an agency in person. Lemonade offers customizable insurance coverages to meet the unique needs of each client.

Explore coverage options, discounts, and more details through our Lemonade insurance review so you can make an informed decision about this company and its insurance products.

| PERKS | DRAWBACKS |

|---|---|

| Affordable insurance rates. | Some of their insurance products are only available in certain states. |

| Easy-to-use mobile app for digital policy management and quick quotes. | It does not offer in-person customer service but totally digital. |

| Claims submitted through the app are paid immediately once approved. | Not all Lemonade policy types are rated by major rating agencies such as J.D. Power, AM Best, Moody’s, or S&P Global. |

| It ranks highly in the J.D Power Renters Insurance Customer Satisfaction Survey. | |

| Through their Lemonade Giveback program, unused premiums are donated to charities. |

Compare Quotes in 2 Minutes

Compare Insurance Quotes and Save!

Secured with SHA-256 Encryption

Lemonade Insurance Overview

Lemonade Insurance Company was founded in 2015 by Daniel Schreiber and Shai Wininger. It is popular for its efficient online claims services and user-friendly digital platform. The company offers several product lines nationwide, but not all are available in all states.

Lemonade does not employ insurance agents or agencies to sell policies; instead, it makes use of artificial intelligence (AI) to determine the cost of premiums and provide low-cost insurance coverage. Policies are only sold through the Lemonade website and mobile app.

Its high-tech business model promises to set itself apart from most traditional insurers in nearly instant payment of a claim. According to the Lemonade website, far from taking months to pay, the company can do it in just 3 seconds once the claim is approved.

Lemonade’s mobile app stands out among competitors for its ease in obtaining a quote, making payments, checking your policies, and filing claims.

For those new customers looking to save some money while being socially and environmentally responsible, Lemonade Insurance Company might be the best option. That is because, through its Giveback program, policyholders can choose the charities and non-profit organizations to which they donate the surplus funds that remain from unclaimed premiums. Lemonade pockets a fixed percentage of premiums as profit and to pay claims. This is a notable difference for Lemonade from most insurance companies, which collect premiums and keep the remaining capital as profit after paying claims and other expenses.

Lemonade Insurance Products

Since 2015 Lemonade has been known for offering some of the lowest rates on its insurance products. The company provides auto, homeowners, renters, life, and pet insurance.

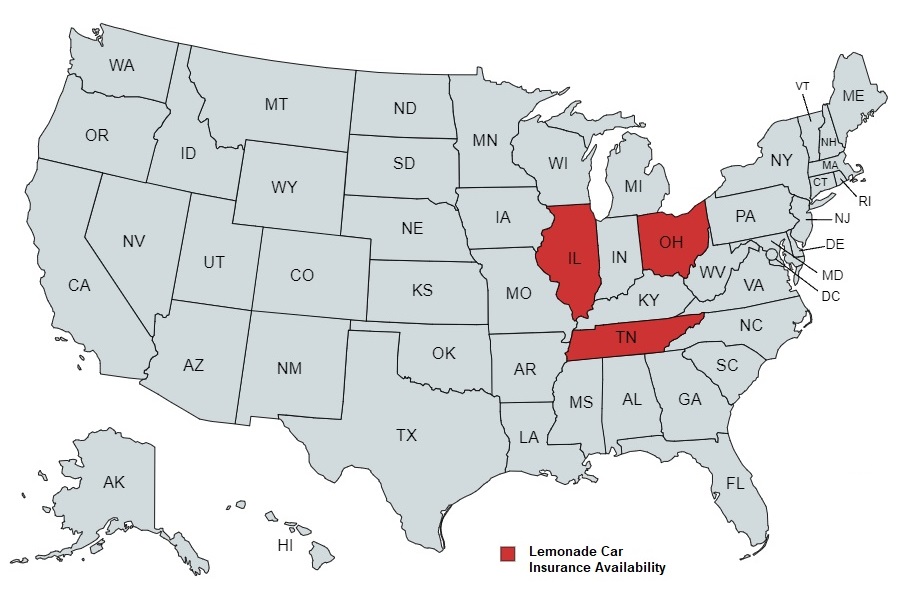

- Lemonade Car Insurance – Unfortunately, the insurer only sells auto insurance in three states so far: Illinois, Ohio, and Tennessee. Drivers from these states can find very cheap auto insurance rates at Lemonade. The basic car insurance policy includes roadside assistance at no additional cost, but other add-ons are limited for certain types of drivers who need specialized coverage.

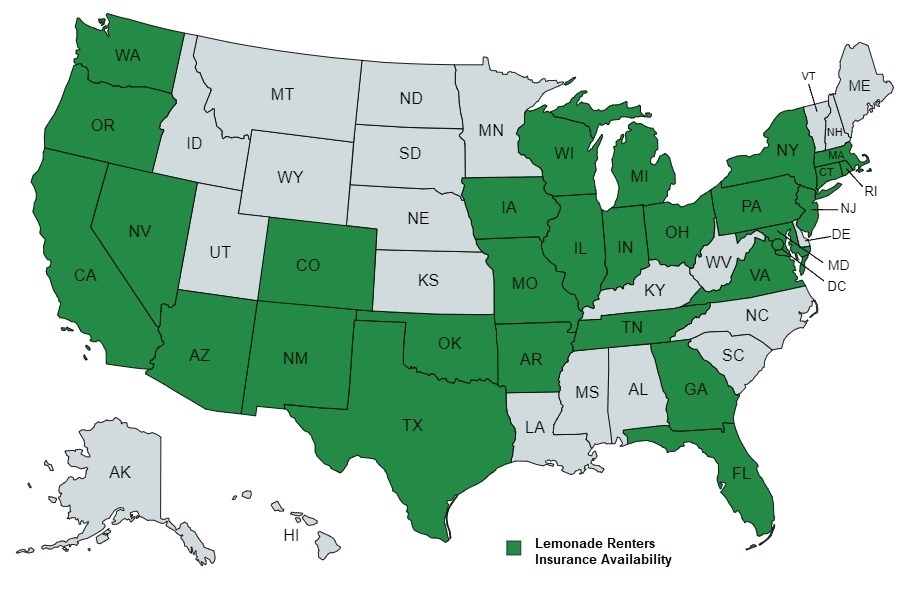

- Lemonade Renters Insurance – If you need basic renters insurance coverage at very low rates, Lemonade is a great option.

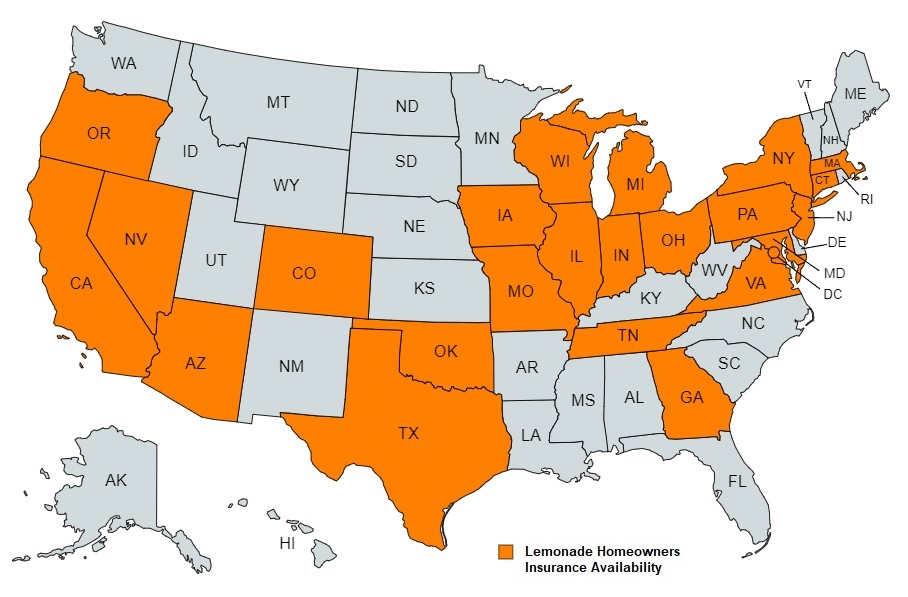

- Limonade Homeowners Insurance – The company offers great rates for homeowners who need basic coverage. However, you should be aware that Lemonade’s insurance coverage add-ons are limited, so some homeowners may find better options with specialty insurers.

- Lemonade Life Insurance – Lemonade offers term life policies at extremely cheap monthly premiums. One of the most significant advantages is that no medical exam is required, but they will determine your rate and qualification at the time you apply.

- Lemonade Pet Insurance – The company offers preventative care programs at a lower cost than the average pet insurer. Lemonade pet insurance policies can save you money on your annual veterinary bills.

Lemonade Car Insurance

Lemonade Auto Insurance is the latest addition to Lemonade’s insurance products. In late 2021, Lemonade announced plans to fully acquire Metromile. This pay-per-mile car insurance company operates in eight states, so Lemonade is expected to expand this type of insurance to more states in the near future.

Car Insurance Availability

Lemonade currently offers auto insurance in only three states: Illinois, Ohio, and Tennessee. However, it is undoubtedly an affordable option for drivers who live in those states.

Lemonade Usage-Based Auto Insurance

Lemonade stands out from other major auto insurance companies due to modern telematics methods to determine customer rates. It could be a good option for customers who appreciate a usage-based auto insurance rating model. By collecting data related to the mileage and driving habits of drivers and their vehicles through its mobile app, Lemonade strives to offer fair and personalized rates that start at $30 per month. However, remember that individual rates will vary depending on a variety of factors, including your driving profile, mileage, and claims history.

Lemonade Giveback Program and Reforestation Program

Lemonade is focused on its mission to create a positive social and environmental impact. To help offset CO2 emissions to the environment of its customers, the company promotes its Reforestation Program which promises to plant trees. When a customer buys Lemonade car insurance, the company determines how many trees to plant-based on the miles they drive.

In addition, the Lemonade Giveback program was launched in 2017, allowing unclaimed premiums to be donated to non-profits selected by each customer when they register for the first time. Lemonade donates excess premiums to charity each year after keeping the amount that covers operating costs and claims payments. In 2021, Lemonade was known to have donated $2.3 million to more than 100 charities. Recently, in 2024, the company donated over $2.1 million to 43 nonprofit organizations worldwide.

Lemonade Car Insurance Costs

One advantage of Lemonade is that its auto insurance rates are significantly cheaper than its competitors. A Lemonade annual minimum coverage policy costs $474 on average. This is $40 per month, which is 43% below the average minimum car insurance premium. Likewise, Lemonade’s full coverage car insurance is also cheaper. An average full coverage policy costs $792, or $66 per month. This represents 54% less than the average full coverage premium.

Below is a comparison chart of Lemonade vs. competitors based on insurance premiums for 30-year-old Illinois drivers.

Auto Insurance Coverage Options

Lemonade’s coverage options do not include many add-ons that help customize the policy for each type of client. Standard policies include basic auto insurance coverages, such as bodily injury and property damage liability, comprehensive and collision coverage, PIP, medical payments, and uninsured motorist.

Lemonade car insurance policies also include roadside assistance services at no additional cost. If your car breaks down the midway, Lemonade will cover towing, tire changes, jump starts, key replacements, and more for users driving with the Lemonade app. That is certainly a notable advantage that promotes the use of the company’s app, given that most insurers charge additional fees for this service.

Additionally, by using the Lemonade app, policyholders can also receive free emergency assistance in the event of an accident. Through the application, the company receives an alert if the client had an accident. In that case, they call back, and if the driver does not respond, the agency contacts the emergency services to send the help the insured needs.

Among the extended coverages that drivers can purchase are glass and windshield coverage. In addition, if your vehicle is being repaired after a covered incident, temporary transportation coverage will cover the cost of a rental car, ride-hailing service, or public or shared transportation for up to one month. If your vehicle is stolen, your policy will cover the cost of replacing it with a new car.

Car Insurance Discounts

Lemonade’s car insurance is remarkably competitively priced, as the company uses real-time driving data to calculate premiums. However, Lemonade car insurance discounts will keep your premiums even lower.

Here are the Lemonade discounts drivers can take advantage of:

- Bundle Discount: Bundling multiple insurance products through Lemonade, including homeowners, renters, pet health, or life insurance, could help you save significantly on your policies.

- Electric/Hybrid Vehicle Discount: Drivers who insure hybrid or electric vehicles may qualify for additional savings and special coverage, such as emergency charging and charger coverage.

- Driving with the Lemonade App: Lemonade requires drivers to download its telematics app. However, if you additionally enable permissions to track your habits and mileage, you can get a participation discount.

- Low Mileage Discount: Through the use of the Lemonade app, you may qualify for a discount by driving fewer miles.

- Payment Discount: If you pay your car insurance bill in full, you will receive an annual discount on your car insurance premium.

- Early Quote Discount: Drivers who plan ahead for savings and get a quote before their current policy expires may qualify for discounted insurance premiums.

Lemonade Renters Insurance

Unlike landlord insurance which covers only the building and structure, Lemonade renters insurance will cover your personal property in the event of damage and theft. This type of insurance is available in 28 states of the country and Washington DC, highlighted in the following map.

Lemonade Renters Insurance Cost

Without a doubt, Lemonade’s Renters Insurance is a very affordable option for customers. The average annual premium for renters insurance is $179, according to the Insurance Information Institute. However, according to Lemonade’s website, their premiums start at $5 per month or $60 per year.

Considering quotes based on $30,000 of personal property coverage, and $100,000 of personal liability coverage, quotes from other major insurers are significantly higher than Lemonade’s. On average, Lemonade Renters Insurance costs $12 per month or $140 per year. This represents 40% less than the average, as can be seen in the graph below.

Lemonade Renters Insurance Coverages

Lemonade renters insurance offers the usual coverages. A renters insurance policy has three main parts: “loss of use” coverage, personal property coverage, and personal liability coverage.

- “Loss of use” coverage plays its part when your rental becomes uninhabitable due to damage. In this case, this coverage helps you with relocation costs.

- Personal liability protects you if someone is injured at your rental, your pet injures a guest, or you are sued for damages.

- Personal property is responsible for covering damaged, lost, or stolen belongings.

Coverage limits for each renter can be lower or higher based on their individual needs, and each customer can choose their own deductible, typically between $250 and $2,500.

The good news is that Lemonade also offers some add-ons to renters insurance policies that provide some additional protection and are listed below:

Extra Coverage

Standard renters insurance policies generally exclude high-value items. Renters who have items that are common targets for theft, such as jewelry, art, or bicycles worth more than $1,500, need extra protection. To do this, they can obtain Extra Coverage to complement their renters policy.

Another advantage of this supplement is that you do not have to pay a deductible for “extra coverage” items. That is, you will not have to pay anything out of pocket to replace your lost or damaged belongings.

Equipment Breakdown Coverage

Suppose any electronics and appliances in your home break down due to a covered incident. In that case, Lemonade covers the costs if you have Equipment Breakdown Coverage included in your renters insurance policy. This includes equipment such as a computer, television, and refrigerator.

Water Backup Coverage

Backup water coverage protects your belongings if your home floods because a pipe or sump pump backs up. This is a common endorsement in property insurance. You should be aware that this insurance will only cover water damage in specific circumstances.

Earthquake Coverage

Damage caused to your personal property by “earth movement” is not covered by a standard renters policy. Renters in California and Arkansas can take advantage of earthquake coverage, which is very important in both states due to the probability of an event of this type occurring. By partnering with Palomar Specialty Insurance, Lemonade was able to offer this coverage as an add-on. This is a point in Lemonade’s favor as not all insurance companies offer earthquake coverage, not even as an additional endorsement.

Lemonade Renters Insurance Discounts

Although Lemonade may offer reduced renters insurance rates based on several factors, such as how old your apartment is or whether you’ve filed a claim in the past, there aren’t many discounts available.

The discounts you can get are:

- Multiple Policy Discount: Get a discount for bundling multiple insurance products.

- Annual Payment Plan Discounts: This discount is available only in select states as long as you enroll in an annual payment plan instead of choosing to pay your premium monthly.

Lemonade Homeowners Insurance

For homeowners looking for a solid digital experience, Lemonade is one of the best home insurance companies out there. If your home is damaged in whole or in part, Lemonade Homeowners insurance will cover the cost to rebuild or repair structures like sheds and garages. If some unfortunate event makes your home unlivable, your homeowners insurance will cover living expenses. After a theft of your personal property, replacement costs are covered. If you need an attorney to defend you in the event that you are sued for liability, this coverage will help cover the costs.

Lemonade Insurance Company currently offers home insurance in 23 states plus Washington DC, as highlighted on the map below.

Lemonade Homeowners Insurance Cost

Homeowners insurance rates are influenced by a number of factors, including your ZIP code, the state you live in, the claims history of your property, the amount of coverage you purchase, and the deductibles you choose.

Among the insurers we reviewed, Lemonade offers the best home insurance quotes in California, with $330,000 of dwelling coverage. Lemonade’s average quote was $1,016 per year, which works out to $85 per month. This represents 19% less than the average quote. As you can see in the chart below, while Geico’s quotes are fairly close to Lemonade’s, Farmers’ and State Farm’s were significantly higher.

Lemonade Home Insurance Coverage

The coverage options provided by Lemonade homeowners insurance are pretty standard. Among the coverage you expect are personal property, liability, home reconstruction, third-party medical payments, and loss of use. The client can choose deductibles ranging from $250 to $10,000.

Much like Lemonade Renters Insurance, the company allows you to bolster your homeowners policy through some additional add-ons. The add-ons available are the same as for renters coverage: water backup, equipment breakdown, extra coverage for valuables, and earthquake coverage. In addition, Lemonade offers homeowners protection against service line damage, foundation water damage, and swimming pool liability.

Home Insurance Discounts

Lemonade offers some typical and basic home insurance discounts:

- Materials Discount – You will qualify for this discount if your home is built with fire-resistant materials such as masonry.

- Fire Protection Discount: You may qualify if you have a sprinkler system or equipment such as a fire extinguisher in your home.

- Protective Equipment Discount – You’ll get a discount if you have alarms or other protective equipment.

- Gated Community: If you live in a gated community, you will get lower rates.

As discounts may vary based on the state you live in and there may be additional eligibility requirements for your location, be sure to speak with a Lemonade representative to verify your chances of qualifying.

Lemonade Term Life Insurance

To provide financial protection for your family members if you die unexpectedly during a predetermined period, Lemonade offers term life insurance, also called “pure life.” Lemonade’s life insurance policies are underwritten by the American Life and Health Insurance Company. Through this term life insurance offering, the company provides a one-time payment to beneficiaries chosen by the policyholder. Fortunately, death insurance benefits are generally free of income taxes.

Term Life Insurance Availability

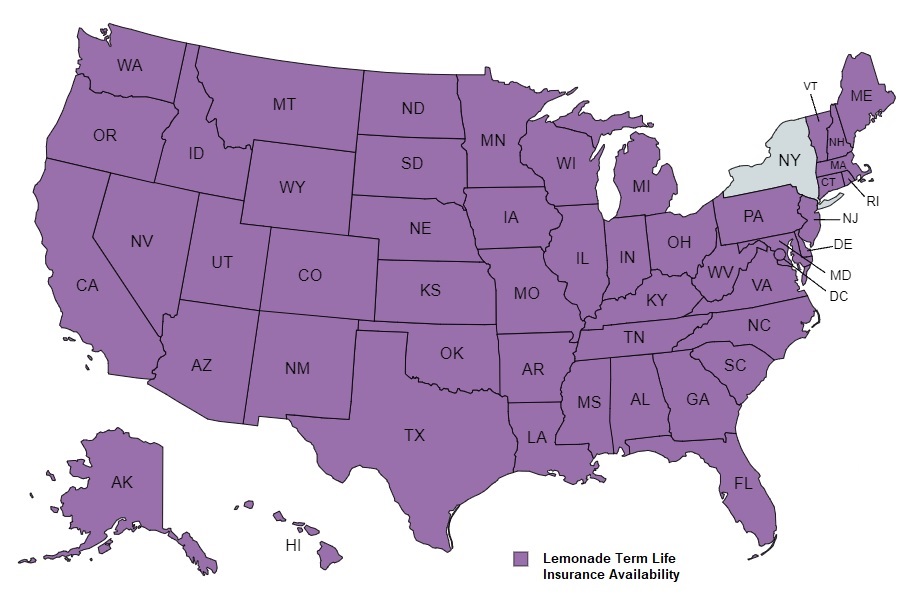

An advantage of Lemonade life insurance is that customers can obtain its policies without needing a medical exam to qualify. So this insurance is a good option for policyholders looking for short-term coverage and those who like the company’s digital approach.

However, obtaining the policies does not require a medical exam, but a health questionnaire is used as part of the online underwriting process. Therefore, not everyone will qualify for this insurance, and those who are eligible but have health problems will pay higher rates, as happens with any other insurance company.

Lemonade life insurance is sold in the vast majority of states, except for New York, as we can see below.

Term Life Insurance Cost

Many factors will influence the cost of your life insurance policy, including your age, health status, the term length of coverage you choose, and the amount of coverage you select.

Term life insurance is an excellent option for those who cannot afford the expense of a permanent life policy. Younger buyers will also benefit from Lemonade Life Insurance’s low costs. That’s because Lemonade’s term life policies are very affordable if you’re in good health, starting at just $9 a month.

Lemonade Pet Insurance Review

Lemonade Pet Insurance covers the costs of procedures, diagnoses, and medications due to your pet’s illness or accident. An optional wellness package includes wellness exams, heartworm tests, blood tests, fecal tests, and immunizations.

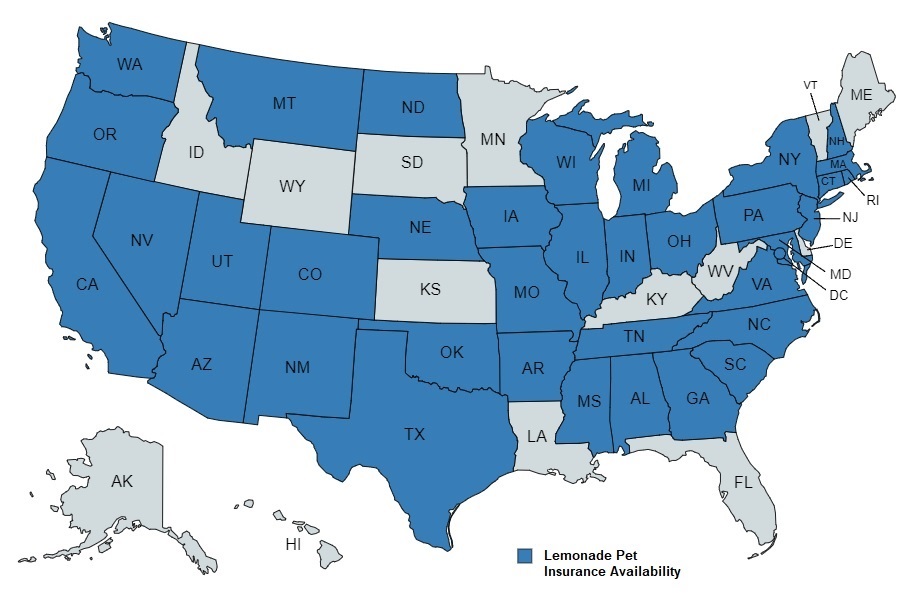

Lemonade Pet Insurance is currently available in much of the country, including 36 states and Washington DC, as highlighted on the map below.

Lemonade Pet Insurance Rates

After analyzing Lemonade’s pet health insurance quotes, we could see that it is cheaper than the average. According to their website, Lemonades insurance rates start at just $10 per month.

A Lemonade insurance policy for a 4-year-old dog costs $324 per year or $27 per month on average. This amount is 12% cheaper than the average rates we found. On the other hand, cat insurance quotes were also cheaper with Lemonade than with the average of the companies we analyzed. An insurance policy for a 4-year-old cat costs $192 per year or $16 per month, which is $12 per year cheaper than average.

Pet Insurance Coverage Options

Lemonade’s standard pet insurance policy covers medical bills if your pet gets sick or has an accident. Diagnosis, X-rays, blood tests, medications, and procedures are included as part of the coverage.

In addition, the company offers additional coverage options that include

- Vet Visit Fees

- Physical therapy

- End of life

Lemonade Pet Insurance Discounts

Lemonade not only has below-average prices but also includes discounts on its policies, making it easy for pet owners to save money while insuring their beloved animals. These discounts include:

- Multiple Pet Discount – If you insure more than one pet with Lemonade, you may qualify for up to a 5% discount on your insurance premium.

- Bundle Discount – You can get discounted rates when you bundle your pet insurance with other Lemonade insurance products.

- Full payment discount – If you pay your annual premium in advance, you can get up to a 5% discount.

Lemonade Insurance Customer Service and Reviews

Like any good company, when it comes to customer service, Lemonade Insurance Company receives both positive and negative reviews. However, according to the National Association of Insurance Commissioners (NAIC), for an insurer of its size, the company receives nearly twice as many customer complaints as normal. That means, of course, that Lemonade’s service is not always well received by policyholders.

Lemonade Insurance Company does not have a financial stability rating from A.M. Best, one of the most recognized insurance rating agencies, but received an “A” (Exceptional) rating from Demotech, which evaluates the financial stability of specialized and regional insurers. This rating indicates that Lemonade has an excellent ability to pay its customers’ claims.

On the other hand, Lemonade renters insurance ranks third in the 2024 J.D. Power Home Insurance Study with a score of 682. Insider also rated Lemonade renters insurance as the best option on the market. However, Lemonade Life & Homeowners Insurance didn’t make the list for J.D. Power’s customer satisfaction survey.

Our website’s intention is only to show you the options; inevitably, it’s up to you to decide if Lemonade is the right choice based on the type of insurance you’re looking for and your particular needs.

Lemonade Website and App

Lemonade can be a very attractive option for those looking to save on their insurance policy. Policies are only sold through the company’s website and mobile app, and it’s renowned for its quick claims process. Lemonade has a user-friendly website that uses artificial intelligence (AI) to calculate rates for its customers.

Lemonade requires those who buy auto insurance with the company to download its telematics app. However, the app goes beyond getting quotes, managing your insurance policy, and filing claims online. One of the benefits of the app is that if you enable permissions to track your habits and mileage, you can get a participation discount, and additionally, you can qualify for usage-based and low-mileage discounts.

From the website and the app, a message that advocates social and environmental good is promoted at all times. As part of this message, Lemonade’s reforestation and Giveback programs can be accessed from the website and app.

As part of the reforestation program, the company will use the app to determine how many trees to plant, based on the number of miles driven, in order to offset the CO2 emissions emitted into the environment by its policyholders.

Lemonade’s app also monitors the driving behavior of its policyholders, checking for speeding, harsh braking, erratic driving, and the time of day they usually drive. Based on these results, Lemonade strives to offer fair and personalized rates and will determine how much you can save on your auto insurance premium.

Final Takeaways

Do you want to get away from bureaucratic processes and are tired of dealing with traditional and monolithic insurance companies? Lemonade Insurance Company could be an inspiring option with very competitive rates.

The company has invested in cutting-edge technology and, through the use of Artificial Intelligence, provides a hassle-free quoting process. Customers looking to compare insurance rates and get a policy can get quotes and their coverage in minutes. Many satisfied customers attest to their positive experiences with Lemonade’s services, including claim submission through the app and fast claim payments.

Social responsibility is the area where Lemonade really excels. Each year the company donates the excess funds to non-profit organizations once they reconcile their annual finances and pay all outstanding claims. When clients go through the process of purchasing a policy, they can determine which non-profit organization deserves to receive their savings according to their own philanthropic principles. According to Lemonade Insurance’s website, the company donates millions to nonprofits year after year.

By meeting strict environmental and social responsibility requirements, Lemonade is considered a Certified B Corporation. So if you buy your insurance with Lemonade, you can feel at peace year after year knowing you’re doing business with a company whose primary goal is to do good.

Compare Quotes in 2 Minutes

Secured with SHA-256 Encryption